Mortgage loans are a significant commitment for both banks and their clients. That’s why experts like you are needed to analyze applications and perform risk analysis before approval.

Are you using the ideal resume template? Is your resume showing you’re the right bet for financial organizations to entrust mortgage loan decisions to?

Whenever financial companies are hiring, they do thorough reviews to choose the right candidates to interview. We’ll help you succeed with our cover letter ai generator and mortgage loan officer resume examples that have landed many jobs in 2025.

Related resume examples

What Matters Most: Your Mortgage Loan Officer Skills & Work Experience

The first thing hiring managers will review is the top skills on your resume to ensure you have the right abilities to make mortgage loan decisions.

With every financial organization having varying approval and review processes for mortgage loans, it’s important to customize the skills you list to each job’s needs. That way, whether they’re using Qualia or Turnkey Lender in their approval process, you can show you’re the right fit.

Here are some of the top mortgage loan officer skills in today’s job market.

9 top mortgage loan officer skills

- Property Valuations

- Qualia

- Market Analysis

- Client Relations

- Loan Processing

- Credit Report Analysis

- Microsoft Office

- Underwriting

- Compliance

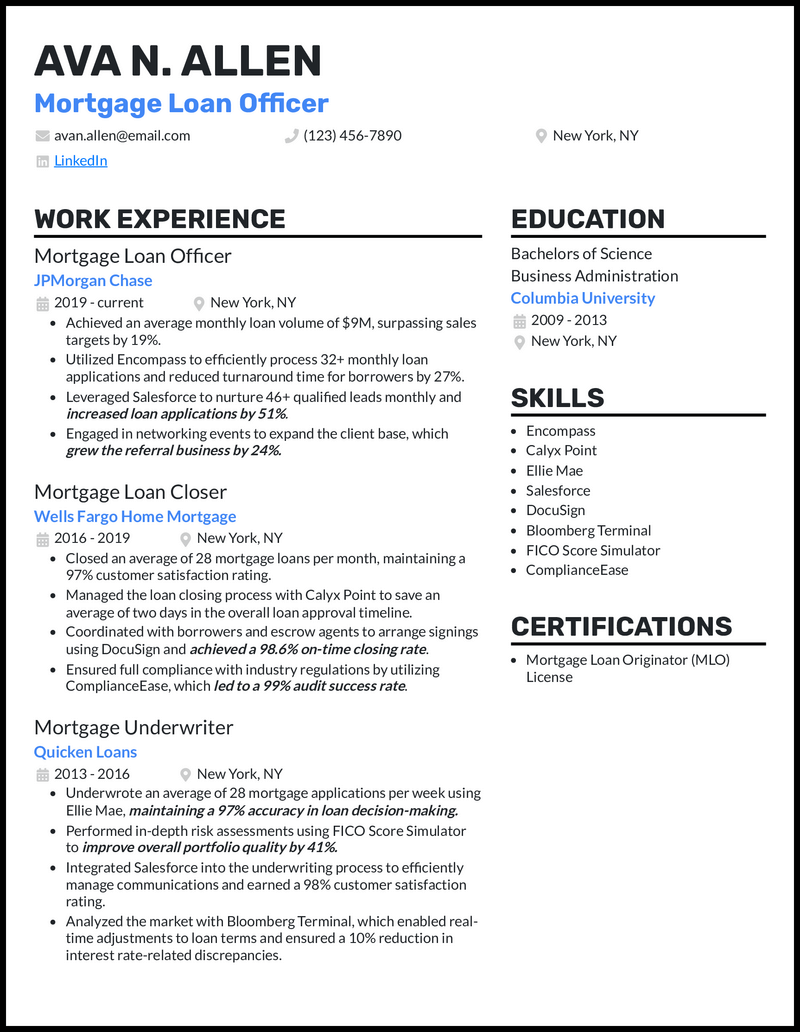

Sample mortgage loan officer work experience bullet points

The results you get during loan processing and decision-making matter a lot for the success of financial organizations, whether that’s ensuring high repayment rates or great customer satisfaction.

To optimize for success, including actionable examples of what you achieved on the job in your work experience examples will help, such as how you implemented Qualia to process loans 58% faster.

You should also keep examples short for easy review, just like you would do when outlining mortgage loan terms, so they’re easily understandable for clients.

Here are a few samples:

- Performed detailed market analysis, reviewing property comps and recent sale prices to boost the accuracy of property valuations by 60%.

- Analyzed Experian and FICO credit reports before approval to boost loan repayment rates by 27%.

- Answered all client questions in a helpful and timely manner while using SAP to process loan agreements faster to boost client satisfaction by 43%.

- Reviewed underwriting processes and procedures, identifying 4 strategies that helped boost compliance rates by 39%.

Top 5 Tips for Your Mortgage Loan Officer Resume

- Always measure your impact

- With the amount of data that goes into loan decisions, you know that the results you get on the job matter. So, always measure the exact impact you had on achievements, such as how you reduced processing errors or improved the accuracy of market data.

- Add impact with action words

- Action words like “processed” or “improved” will help emphasize the impact you make. For example, you could say you “processed over 200 mortgage loan applications, performing risk analysis to reduce loan defaults by 66%.

- Use reverse chronological formatting

- Just like the housing market is constantly changing, so are your skills as a mortgage loan officer. You should always list your work experience in order of recency to present your most relevant abilities in market analysis and loan processing while also showing how you’ve grown in your career.

- Limit it to one page

- While a lot goes into aspects like property valuations, hiring managers don’t need every detail on your resume to know you have the right skills. So, stick to a concise one-page resume that makes your primary skills in application processing and risk analysis stand out.

- Organize the information

- Approach your resume with the same mindset you have when reporting financial data. It should be organized for easy review from hiring managers with clear headers, bullet points with key loan processing skills and experiences, and easily readable 12-14 point font.

There are still many ways you can present skills that’ll make you a great loan officer. You could include achievements you had while obtaining your finance degree, a short career objective, or transferrable skills like performing data entry or customer service.

Listing three or four jobs will work best for mortgage loan officers. You should include the most recent ones and aim for positions that use a relevant skill set, such as ones involving client relations or market analysis.

Resume summaries work well when you have ten or more years of experience. It could include a few sentences about how you’re a detailed mortgage loan officer who uses a multi-layered market analysis process to ensure 98% accuracy in the data gathered.