Making decisions on loan applications is a significant process for financial organizations. That’s why you’re there to go through in-depth processes, ensuring that applicant eligibility, credit standings, and loan amounts align with the right standards.

Is your resume template helping you align your skill set with each financial organization’s needs?

With your decisions significantly impacting a bank’s success, hiring managers will want to ensure they choose the best applicants for the job. Our loan processor resume examples and cover letter maker will help you structure yours to stand out during those detailed reviews.

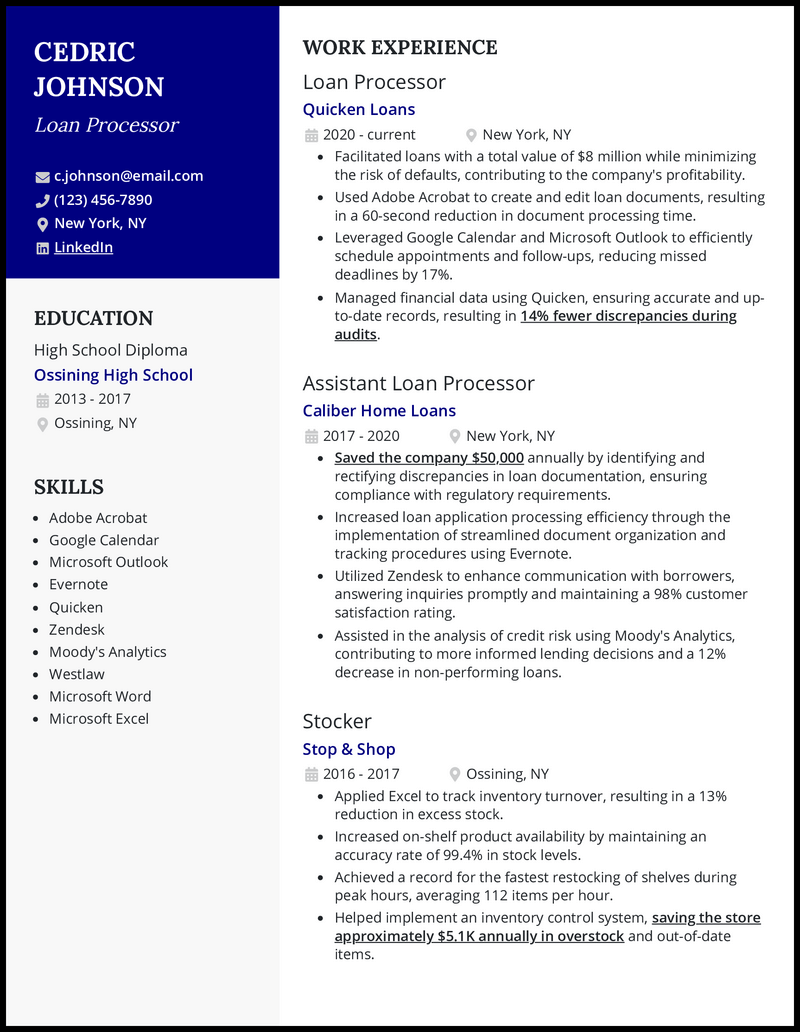

Why this resume works

- How well do you know the company you’re applying for a job to? Do your homework because that’s one way to boost your loan processor resume’s chances of making the final cut.

- In this example, Cedric does something much better than just showing his knowledge of the potential employer. He highlights the use of Quicken which is a property of the company he wishes to work for. It’s a perfect match of interests.

Why this resume works

- You may not have direct experience for the job you’re applying for. Does that mean you have almost zero chances of getting hired? Not at all.

- Your career objective is the secret weapon you can deploy and give your entry level loan processor resume what it lacks in experience. Clearly state your vision confidently and detail how your professional ethos aligns with the potential employer’s beliefs and goals.

Why this resume works

- Are you a terrific team player and someone who goes out of your way to ensure timely and efficient service delivery? Those are two attributes that would make your loan processor assistant resume a favorite among recruiters.

- Like Sterling’s idea of highlighting his role in a project to support literacy among unreached communities, show how against all odds, you can overcome hurdles and ensure goals are met in time.

Why this resume works

- Your knowledge and use of niche tools can set your senior loan processor resume for success. But it comes down to how you articulate your competencies in your previous jobs.

- In this case, accompanying what you used each tool for, and the impact achieved would be a perfect blend to let hiring teams know what you’re bringing to the table.

Why this resume works

- We get it—as an indirect loan processor, your desk is probably a perpetual valence of tasks. That’s not a good enough excuse to submit an untailored resume, though. So, brush off those detective skills and zero in on what the job ad is really asking for.

- There are no hard-and-fast rules about how many times you should read the job posting; take as long as you need to fish out job-relevant keywords and phrases and then sprinkle them all over your indirect loan processor resume to show you fit the bill.

Why this resume works

- Picture your high-value real estate loan processor resume as a highlight reel of your most impressive career wins. And don’t just talk about what you’ve done but dazzle with the impact you’ve made.

- You see quantified metrics like “approving loans worth $55 million quarterly?” That’s gold right there. They have a special place in the recruiter’s heart, so don’t even think twice about flaunting them in your resume to put your true potential in the limelight and set the stage for your next big career move.

Why this resume works

- It doesn’t matter where your career started. What matters is what you did with the first opportunity you got to show your potential to work in a fast-paced environment.

- Being a retail cashier right after your associate degree speaks volumes of your ambition to make a difference in a real-world workplace. Seize this opportunity and let your mortgage processor resume highlight achievements that sum up your knack for perfection and learning from experiences.

Related resume examples

Strategize Your Loan Processor Resume to Align with the Job Description

When you’re analyzing loan qualifications, you look for crucial indicators for approval, like credit payment history and an applicant’s income. Hiring managers will take a similar process while reviewing your resume, looking for indicators that you’ll be successful.

To strategize for success, you need to choose the right job skills. Start with the job description and look for things each company emphasizes. Does an organization specialize in home loans? Then, listing skills in mortgage processing and property valuations may be essential. Always list a tailored set of skills for each job.

Need some ideas?

15 best loan processor skills

- Risk Analysis

- SAP

- Microsoft Excel

- Forecasting

- Mortgages

- Refinancing

- FICO Scores

- Customer Service

- Negotiation

- CreditScope

- Qualia

- VueCentric

- Loan Origination

- Underwriting

- Small Business Lending

Your loan processor work experience bullet points

Your skills in risk analysis and underwriting will get you off to a great start. Now it’s time to show hiring managers exactly why you’re the best loan processor for the job.

Including the right metrics is a great way to optimize your work experience bullet points. So, consider how you’ve helped financial institutions in the past, such as how your thorough risk analysis process boosted loan repayment rates.

Here are some great metrics for loan processors to use on resumes.

- Compliance rates: Compliance in record keeping, loan approvals, and contracts is essential in the financial industry.

- Efficiency: When someone applies for a loan, they want fast results. That’s why loan processors who can implement strategies like using SAP or Qualia in their processes for better process efficiency will stand out.

- Client satisfaction: The client’s experience is just as important as the bank’s, so being able to draw up loan contracts that are mutually beneficial and explain information is key.

- Cost savings: Whether it’s switching clients to paperless billing or reducing employee hours spent on approval processes, any way you can reduce costs will stand out.

See what we mean?

- Streamlined document retrieval and verification procedures, reducing the average processing time from 48 hours to 36 hours.

- Implemented a paperless document management system, saving the company approximately $10,000 annually in printing and storage costs.

- Reduced loan processing errors by 22% through meticulous data validation, leading to improved customer satisfaction.

- Leveraged CreditScope to evaluate creditworthiness, resulting in a 19% improvement in the accuracy of credit decisions and a reduction in loan delinquencies.

9 active verbs to start your loan processor work experience bullet points

- Analyzed

- Processed

- Negotiated

- Streamlined

- Introduced

- Managed

- Oversaw

- Maintained

- Increased

3 Tips to Make Your Loan Processor Resume Stand Out with Limited Experience

- List educational achievements

- Entry-level loan processors can lean on what they achieved while obtaining their finance or related degree to make relevant skills stand out. For instance, how you maintained a 3.9 GPA or received a 99% overall grade on a fiscal analysis project using QuickBooks to analyze spending.

- Consider an objective

- A resume objective can work well for inexperienced loan processors. For example, you could write about how you’re a dedicated professional ready to use the forecasting and market analysis skills you picked up while obtaining your finance degree to ensure accurate mortgage lending.

- Include transferable experiences

- Even if you haven’t worked as a loan processor, other experiences can translate to success in the role. For example, having worked at the service desk at a retail store, providing excellent customer service by efficiently processing returns and answering questions could show your abilities to create a great experience for financial clients.

3 Tips for a Top-Notch Loan Processor Resume When You’re Experienced

- Use the right formatting

- Financial needs are constantly changing to ensure compliance. Therefore, you should list your most recent loan processing experiences first to showcase how you perform refinancing and stay within GAAP standards based on today’s needs.

- Keep it on a single page

- While you have a lot of experience, keeping your resume concise and making it easy for hiring managers to review is still important. To do so, try to narrow in on what’s most important to each company, such as forecasting and small business lending for a company that provides startup loans.

- Consider using a summary

- Experienced applicants often benefit from a resume summary. For instance, you could write about how you’ve refined automation processes using SAP over your 11-year career to reduce loan processing times by an average of 44% to ensure excellent client experiences.

You’ll want to limit it to three or four jobs. The right ones to include will be those that were the most recent and used a relevant skill set, such as using Qualia and Credit Scope for a company providing mortgage loans.

Start by listing the exact job title at the top of the resume, such as “senior loan processor.” Then, throughout your resume, list some top skills and experiences exactly as they’re written in the job description, such as VueCentric or risk analysis.

While you can use the same structure and resume template to speed up the process, you should still list a custom set of loan processing skills and experiences to optimize for each job’s needs. For example, one company may specialize in commercial lending, whereas another focuses on small business lending, so you’d want to list skills that make sense for each.