Anyone applying for a loan can use some helpful guidance along the way. You help with excellent client service, application evaluations, and creating effective data payment plans.

Have you properly evaluated your top skills? Can you present them effectively with your current resume template?

Banks rely on loan officers to approve clients for the right types of loans and funding, so they’ll want to ensure you have the right skills for the job. You can use our loan officer resume examples as an easy template for success in the hiring process.

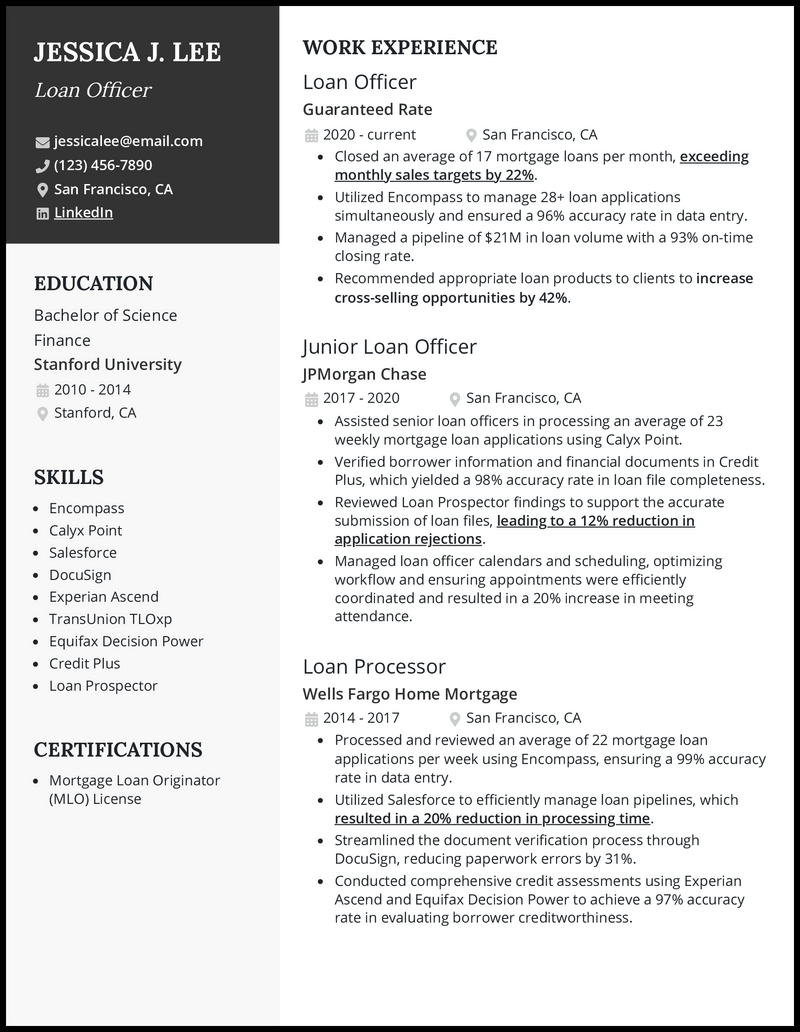

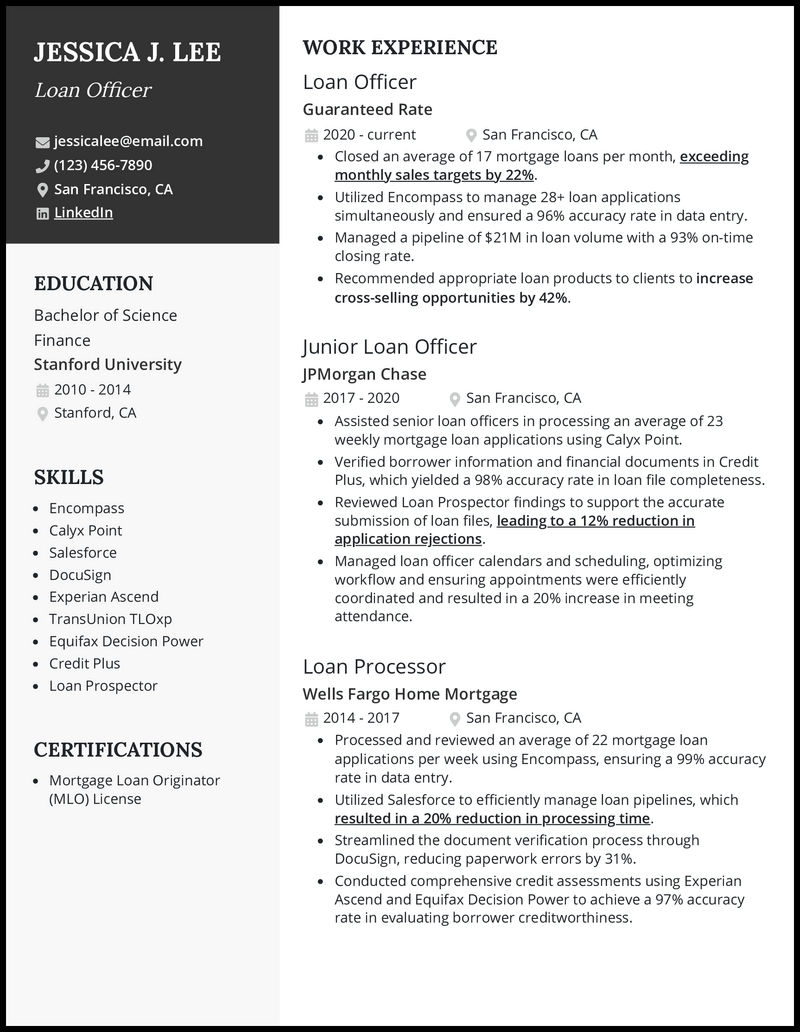

Why this resume works

- Even the best and brightest in the world can’t practice as a mortgage loan officer without a Mortgage Loan Originator (MLO) license. Before you do anything, add your MLO to your loan officer resume in order to be seriously considered for future roles.

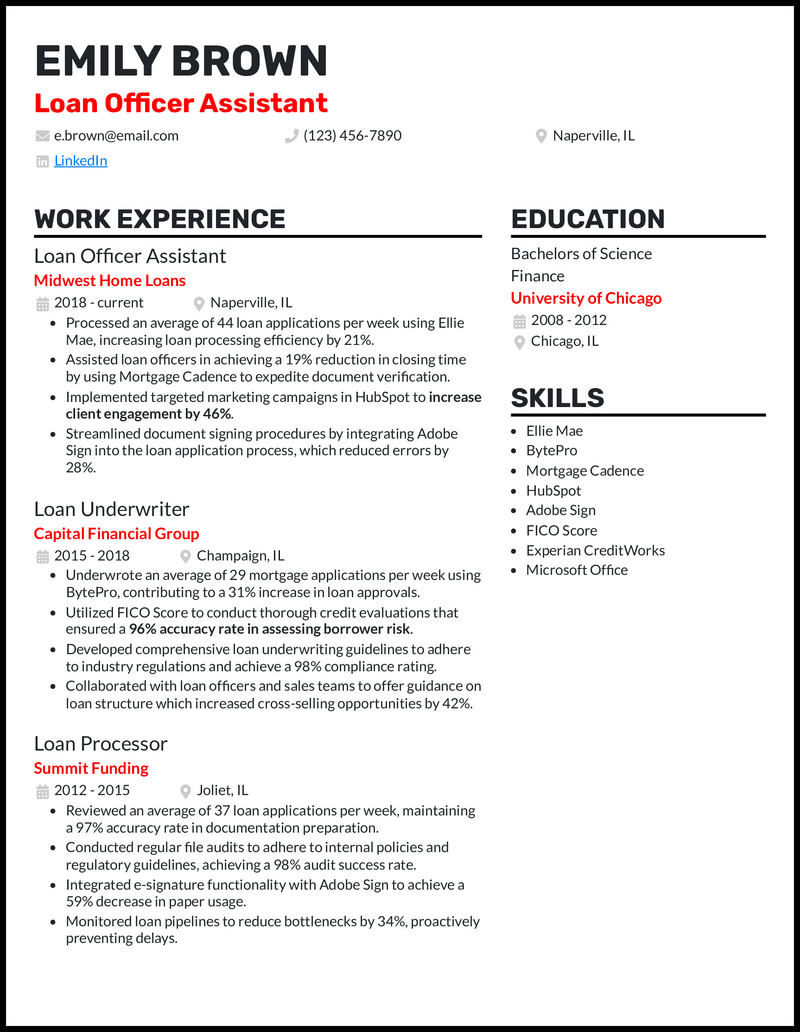

Why this resume works

- Attention to detail is a critical trait for a successful loan officer assistant. After all, you’re dealing with numbers in a business where every decimal point carries significant implications for the client.

- Show potential employers that you have an affinity for money math by showcasing your finance degree on your loan officer assistant resume.

Why this resume works

- Landing a job as a new graduate can be daunting, given the competitive landscape of the job market. Tailoring your entry level loan officer resume to include industry-specific seminars and workshops attended during college years can save the day.

- You want to specify insights or skills gained from these educational experiences, solidifying your potential to add value to the hiring company. Conclude with a compelling career objective that emphasizes your ambitions for the role and company.

Why this resume works

- Picture your senior loan officer resume brimming with relevant metrics-backed wins showing just how awesome you are at closing deals. You might as well be ready to shake the hiring manager’s hand, promising you won’t waste the opportunity.

- Dropping genuine quantified results like “contributing to a $2.3 million in loan origination volume” isn’t just impressive—it’s a beacon calling out to recruiters with your potential impact. They grab attention instantly, nudging the potential employer to think they’ve got to get this talent on their team right away.

Why this resume works

- Haven’t dipped your toes into the loan officer pool yet? Absolutely no worries. But that doesn’t spell doom for your chances—showcasing your mastery of industry-specific software in other roles or college projects can compensate for your seemingly limited job experience.

- Tools like Encompass by Ellie Mae, Salesforce, and LoanPro should definitely grace your new loan officer resume’s skills section. But don’t stop there; spilling the beans on how you’ve put these tools to use in the past or present is the key to making a memorable impact.

Why this resume works

- Using numbers in your commercial loan officer resume won’t just quantifiably back up your claims; it makes your achievements stand out in an ocean of text. However, don’t just focus on percentages.

- Detailing how you trimmed loan processing time by an exact number of days or increased revenue by a specific dollar amount illuminates your ability to deliver tangible business outcomes, painting a picture of your potential value to the prospective employer.

Why this resume works

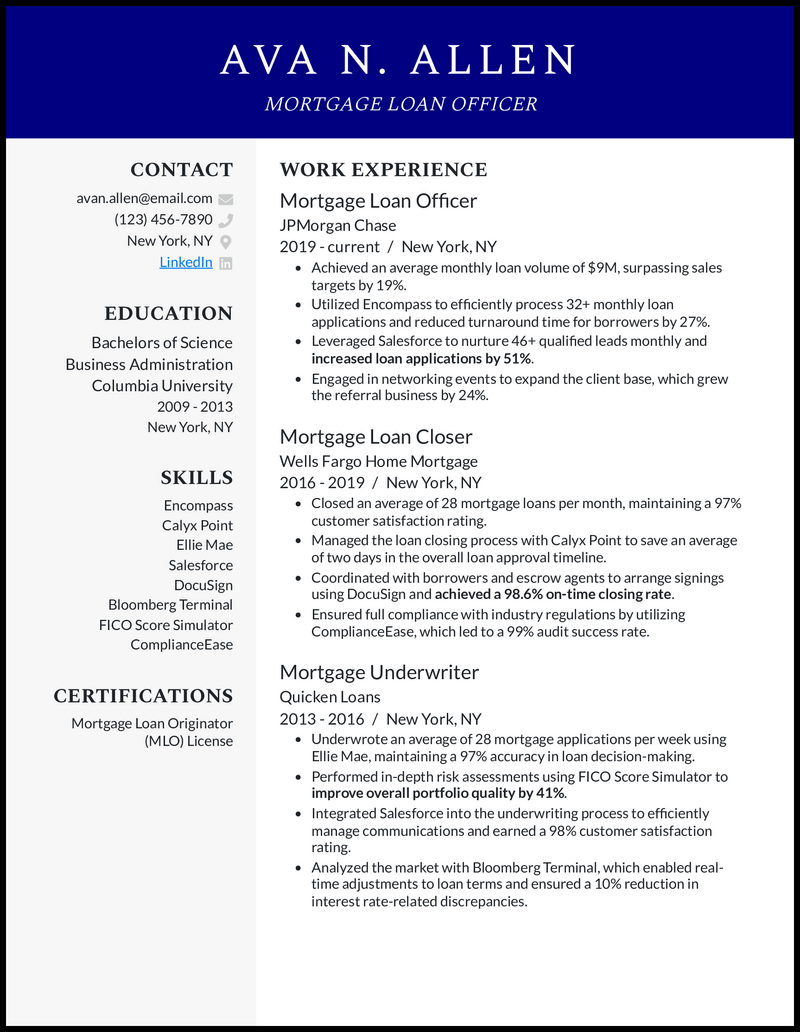

- You oversee the end-to-end mortgage process as an officer. That means the more you know about each distinct step, the better you’ll perform.

- Showing a progression in the business from underwriter to closer to officer on your mortgage loan officer resume emphasizes your strong foundation to recruiters.

Related resume examples

Create a Tailored Loan Officer Resume for Each Job Description

When applying to banks and lending offices, you’ve probably noticed each company has its own unique specialties and needs from loan officers. That’s why you must tailor the skills you list for each job you apply to, not only when writing a cover letter, but also in your resume.

For instance, if you were applying to a bank needing a loan officer specializing in mortgage loans, you could include skills like property evaluations and FHA loans.

Need some ideas?

15 best loan officer skills

- Mortgage Loans

- Portfolio Management

- Experian CreditWorks

- Client Relations

- Microsoft Office

- DocuSign

- Bloomberg Terminal

- Commercial Loans

- Financial Analysis

- Team Collaboration

- Quickbooks

- Regulatory Compliance

- TransUnion TLOxp

- Salesforce

- Encompass

Your loan officer work experience bullet points

You’ll have caught the hiring manager’s attention with top skills like regulatory compliance and portfolio management listed on your resume. The next step is to show them what you’ve achieved while using those abilities as a loan officer.

A great way to optimize is by using metrics-based examples to help illustrate what you achieved.

Also, try to keep each example short and simple to make your impact clear, just like you’d do when outlining essential financial information for clients.

Here are some great metrics hiring managers will love to see on loan officer resumes.

- Abandoned loan rate: When you approve someone for a loan, you want them to go through with the deal rather than going elsewhere, so banks will want to bring on loan officers who can sell clients on the benefits of working with their organization.

- Customer satisfaction: When you meet with clients, it’s important to provide them with friendly and helpful service, so banks will always be concerned about satisfaction scores.

- ROI: Every bank will want to know the expected returns you can achieve after loan approvals.

- Net charge-off rate: When you approve loans, you want to ensure the customer can pay it off, so reducing net charge-off rates is an excellent sign of quality performance.

See what we mean?

- Reviewed Loan Prospector findings to support the accurate submission of loan files, leading to a 12% reduction in application rejections.

- Utilized Encompass to efficiently process 32+ monthly loan applications and reduced turnaround time for borrowers by 27%.

- Leveraged Salesforce to nurture 46+ qualified leads monthly and increased loan applications by 51%.

- Engaged in networking events to expand the client base, which grew the business referrals by 24%.

9 active verbs to start your loan officer work experience bullet points

- Achieved

- Leveraged

- Managed

- Underwrote

- Integrated

- Analyzed

- Processed

- Reviewed

- Monitored

3 Ways to Optimize a Loan Officer Resume if You Lack Experience

- Fill in with transferable skills

- When you don’t have much work experience as a loan officer, you still will have many transferable skills you can apply from other fields you’ve worked in. For instance, jobs involving customer service or data analysis would apply well to show you’re detail-oriented for a financial position while providing an outstanding client experience.

- Emphasize skills gained through education

- Your bachelor’s degree in finance, business administration, or other related fields will have provided you with many abilities that have prepared you to succeed. For instance, you could explain how you received a 96% overall grade on a class project where you made a detailed analysis of end-of-year income statements.

- Use a career objective

- A resume objective will help showcase your top financial skills and connect with hiring managers on why you want the job. For instance, you could explain how you’re a motivated financial professional who is eager to apply your two years of portfolio management experience to help clients get the best results when applying for loans.

3 Tips to Elevate Your Loan Officer Resume When You Have Experience

- Keep your resume to three or four jobs

- Limiting your resume to three or four jobs is optimal if you’ve worked in many financial positions. You should list your most recent jobs and those most relevant to key skills the company is looking for, like mortgage loans or Experian CreditWorks.

- Add a summary

- Showcasing some impressive experiences right away can impress hiring managers in financial positions. For instance, you could explain how you’ve managed a portfolio of accounts valued at $2.1 million over your 11-year career while limiting net charge-off rates to just 1.2% during that time.

- Emphasize measurable impacts

- When you have experience, you’ll have much more data you can include about ROI and customer satisfaction scores. Ensure your work experience examples have data points about what you’ve helped banks or lenders achieve.

You should limit your loan officer application to a one-page resume. If you’re struggling to narrow it down, consider ways to narrow in on essential company needs. For instance, commercial lenders would be very interested in your portfolio analysis and business evaluation skills.

Every bank and lending organization operates a bit differently, so it is important to customize your resume each time. That way, skills like Quickbooks or credit analysis that a company is looking for will stand out to hiring managers while reviewing your resume.

Action words like “reviewed” or “analyzed” are a great way to make what you achieved sound more impactful. For instance, you could say you “analyzed credit profiles of loan applicants in Equifax Decision Power to boost approval quality, leading to a 54% decrease in net charge-off rates.”