Choosing the right insurance and filing claims can be confusing for many people. That’s why pros like you are needed to help customers choose plans, investigate claims, and answer questions quickly.

Does your resume detail the right skills to impress insurance hiring managers?

Just like you’ll walk customers through the best insurance plans for their needs, allow us to help you choose a resume template and create a cover letter that wins. We’ll get you on the right track with our insurance resume examples designed to stand out in today’s job market.

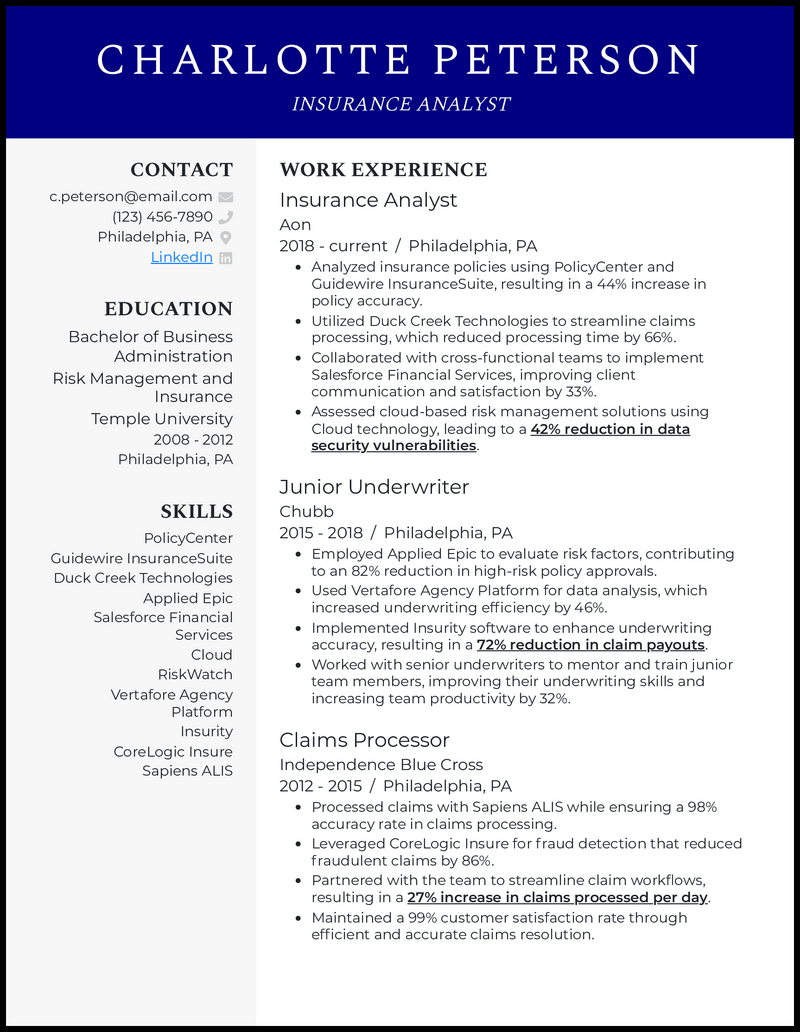

Why this resume works

- Sales and more sales is the language that all insurance companies understand. From the onset, present your sales record by showing the number of new and retained clients.

- And because you’ll be working with cross-functional teams, your insurance resume must show how you fostered a collaborative environment and contributed to the overall success of the company.

Why this resume works

- Less words and more actions in your insurance agent resume will get you noticed. But how do you pull this trick? Simple. Detail your client-focused approaches that netted more customers and converted businesses.

- Since it’s the digital era, your successes in email marketing campaigns will give your application a competitive edge.

Why this resume works

- A strategy that worked in this insurance adjuster resume is amplifying the impact in previous roles, including boosting claims accuracy and processing speed.

- In your piece, harness the power of past accomplishments and display your competency in industry-specific software such as ClaimRuler and FileTrac.

Why this resume works

- It’s time to show any potential employer you’re not the average agent who creates a bad repo for the company by contacting people without a care in the world. Rather, show how you use professional strategies like tracking conversations and creating personalized insurance plans.

- Such phrases in your life insurance agent resume will prove your credibility as not just someone who can effectively sell policies but also create a strong connection with clients.

Why this resume works

- Proving that you’re a genuine insurance agent in healthcare is going to be your first priority. This is one of the few times where you do want to sweat the details.

- Traditional insurance tools are going to be expected in a health insurance agent resume, so include industry-specific platforms like HealthSherpa and trusted sites like HealthCare.gov to show that you have honed experience in providing health insurance plans.

Related resume examples

Write an Effective Insurance Resume for Each Job’s Needs

Every insurance industry and firm operates a bit differently. That means it’s essential to include a custom set of skills in your resume to stand out. For example, while applying to be a medical insurance claims analyst, you may want to emphasize skills in medical records analysis and ICD-10 codes.

Additionally, insurance jobs are highly technical and based on industry compliance, so focusing more on technical skills like Xactimate or claims processing will be a good idea.

Need some ideas?

15 top insurance skills

- Underwriting

- Customer Service

- Prospecting

- Claims Processing

- Lead Generation

- Xactimate

- HubSpot

- Negotiation

- Risk Assessments

- Disclosure Obligations

- Fixed Annuities

- LexisNexis

- Axonwave

- Medical Canvassing

- Accident Reports

Your insurance work experience bullet points

When both customer satisfaction and the profitability of insurance firms are in your hands, the results you can get on the job are crucial.

In your work experience bullet points, it’s important to write more than just job duties like “responsible for processing claims.” Instead, make these examples actionable achievements, such as using cold calling to generate more leads.

You can emphasize that impact further by using metrics like the ones below on your insurance resume.

- Customer satisfaction: Many insurance-related jobs like advisors and agents involve working directly with customers, making satisfaction rates a great metric to list.

- Sales revenue: Are you applying for an insurance sales job? Then, writing about how you helped generate more revenue can be a great idea.

- Processing times: Many claims-related insurance roles will benefit from faster processing times to get clients the best results.

- Valuation accuracy: While analyzing customer financial portfolios and properties, the accuracy of your valuations will be crucial in assigning them the right insurance plans for their needs.

See what we mean?

- Conducted comprehensive property damage assessments using Xactimate, resulting in a 44% increase in accurate claim payouts.

- Leveraged Salesforce Sales Cloud to orchestrate targeted marketing campaigns, which resulted in a 77% growth in the client base within six months.

- Achieved a 96% customer retention rate by utilizing AgentCubed to automate policy renewal reminders.

- Developed customized training sessions on AgentCubed, improving staff proficiency by 44%.

9 active verbs to start your insurance work experience bullet points

- Identified

- Collaborated

- Assessed

- Processed

- Partnered

- Maintained

- Managed

- Estimated

- Improved

3 Ways to Improve Your Insurance Resume When You’re Lacking Experience

- Add transferable skills

- Even with little experience, many previous jobs in different industries can translate to insurance roles. For example, you could include how you performed customer service while working as a receptionist or managed confidential information as a data entry clerk.

- Use an objective

- Resume objectives help inexperienced candidates stand out with their career ambitions and some key skills right away. Your objective could include a few sentences about how you’re a detail-oriented professional with three years of confidential data management experience as a medical receptionist, ready to apply your accurate abilities as an entry-level medical insurance claims processor.

- Include hobbies/interests

- When you don’t have much experience, relevant hobbies & interests can also make you stand out. For example, your time compiling donation records for an Alzheimer’s non-profit could help show your abilities to perform accurately in an insurance environment.

3 Ways to Optimize Your Insurance Resume When You Have Experience

- Reverse chronological order works best

- As you’ve grown your career, your ability to process claims and perform in-depth investigations will have greatly improved. So, you should list your most recent experiences first to emphasize your most relevant abilities to insurance hiring managers.

- Keep it on a single page

- While a lot goes into aspects like medical canvassing and disclosure obligations, hiring managers don’t need all the details to know you’ll be successful. Keep to a concise one-page resume to make your primary insurance skills stand out.

- Use a summary

- Experienced insurance applicants can often benefit from a resume summary. For example, you could write a couple of sentences about how you’ve managed over 1,200 client portfolios using HubSpot to continuously boost client retention and satisfaction by an average of 7% year over year.

Three or four jobs will work best for insurance resumes. You’ll want to include your most recent jobs and those using a relevant skill set to the role, such as knowledge in Salesforce and lead generation for an insurance sales position.

Action verbs like “processed” or “examined” help you speak in an active voice that adds impact to your examples. For example, saying you “processed 130 claims using medical canvassing to identify fraud 37% more accurately” sounds much more impactful than just saying you were “in charge of claims processing and medical canvassing.”

A great way to optimize for ATS checks is to include the exact job title toward the top, such as “insurance claims processor.” Then, put some essential job skills exactly as they’re listed in the job description throughout your resume, such as LexisNexis or accident report analysis.