Financial analysts have different duties and responsibilities based on seniority level and business sector, making it hard to decide what to include on your financial analyst resume when applying for that dream finance job.

You must also know how to format your resume, what information to include, and what projects to highlight to attract the attention of a hiring manager or recruiter.

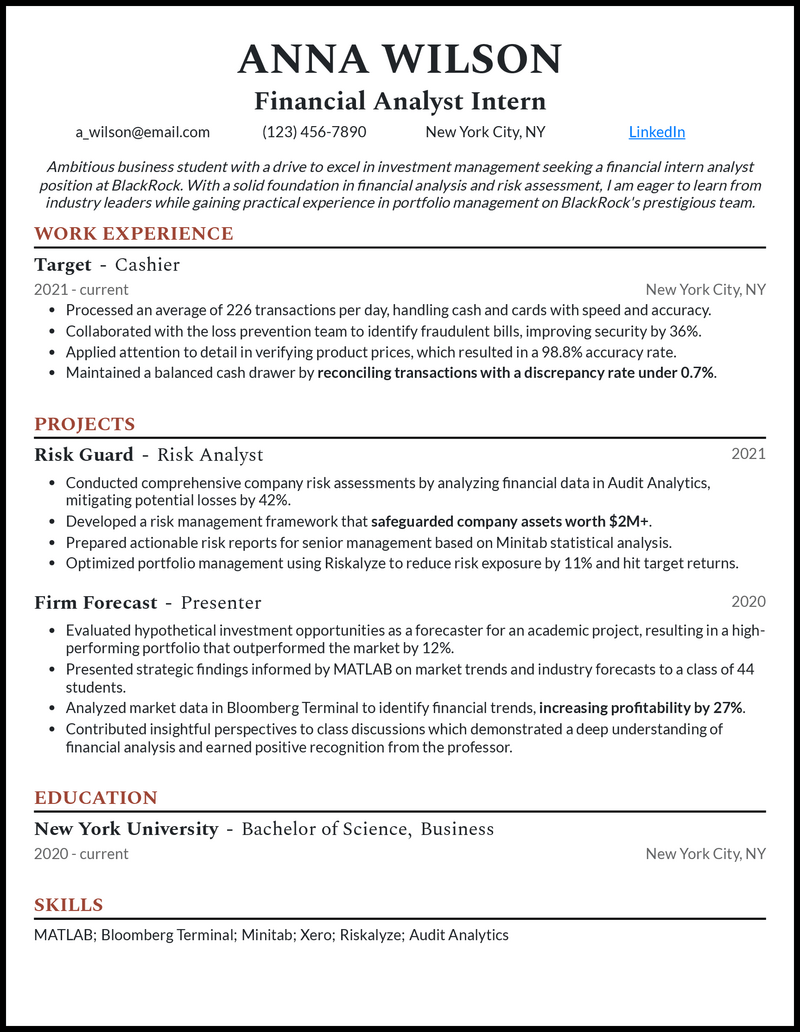

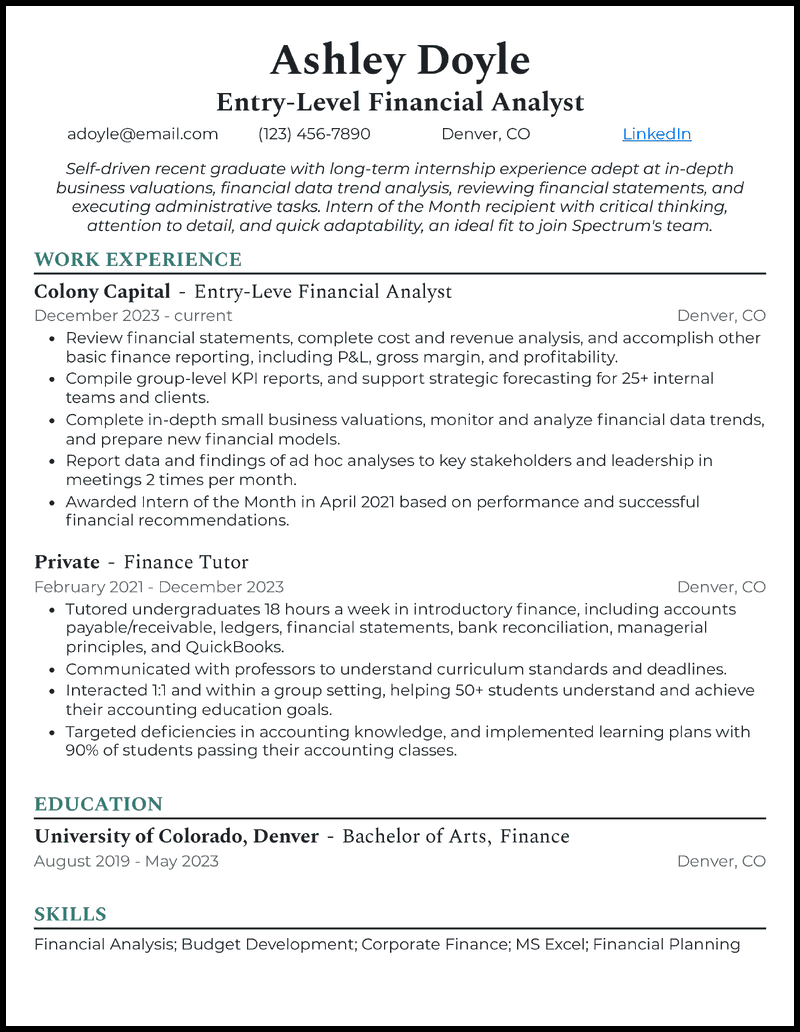

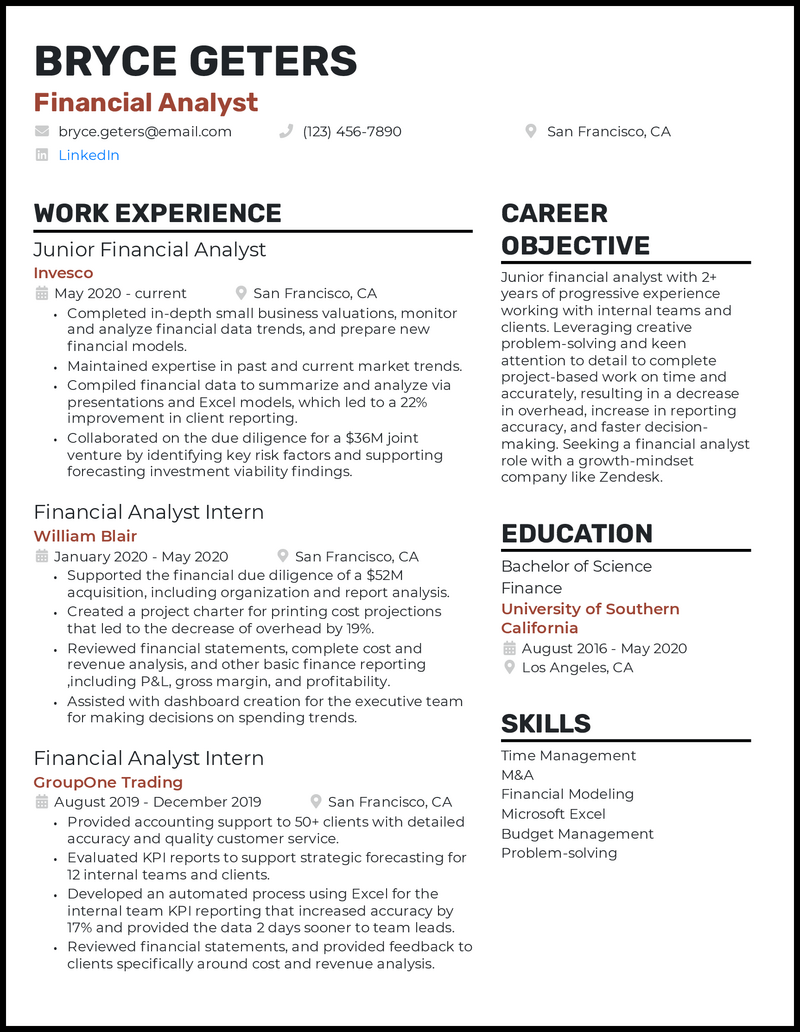

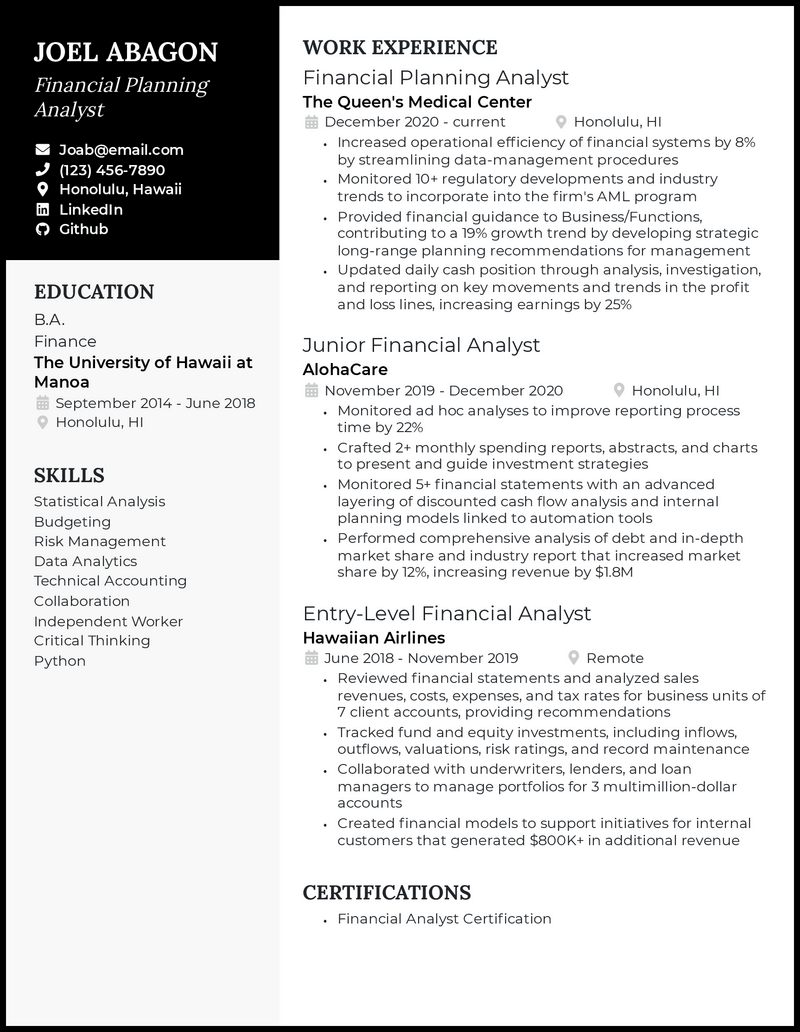

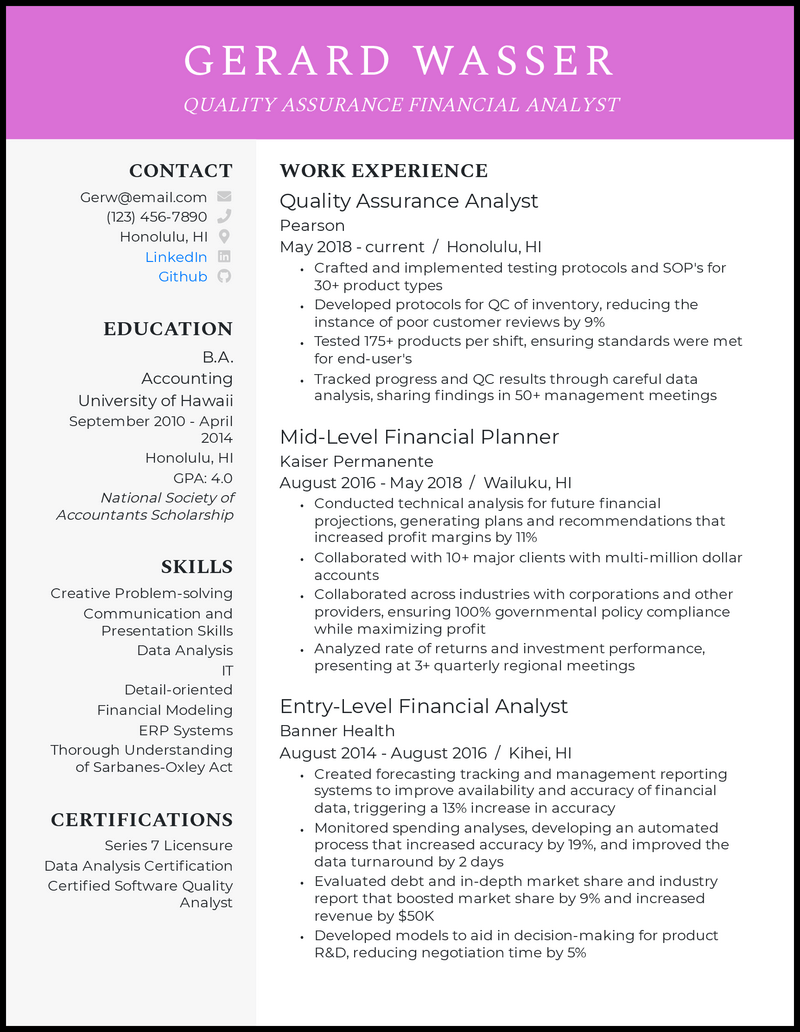

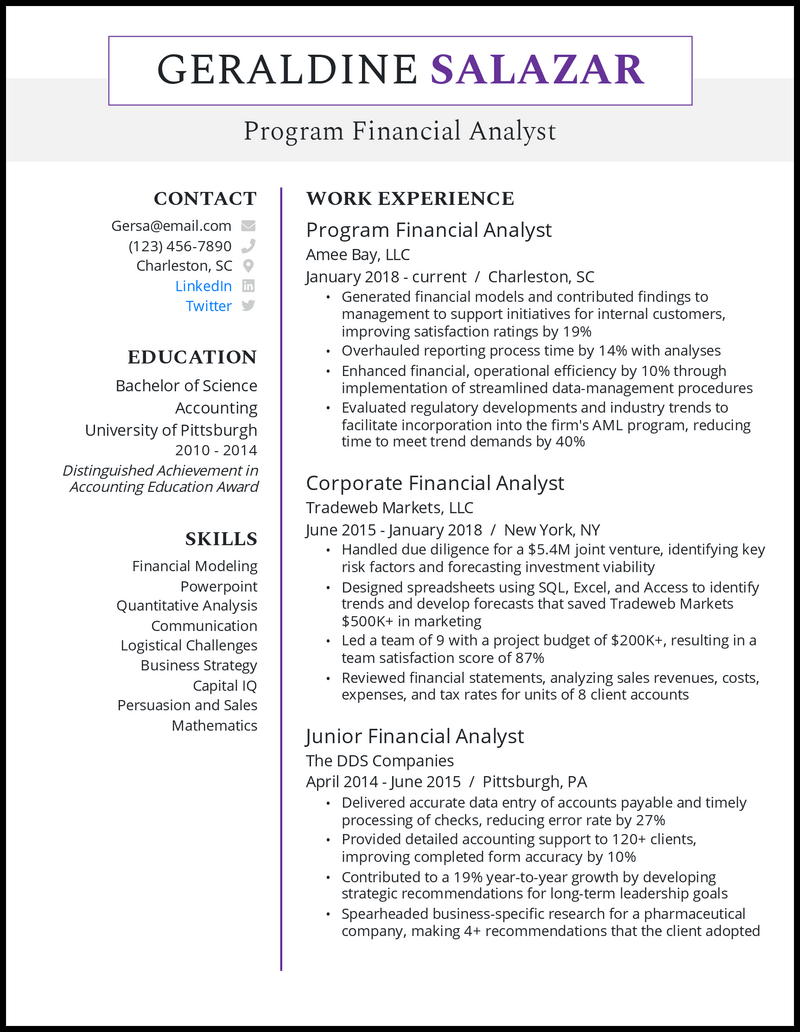

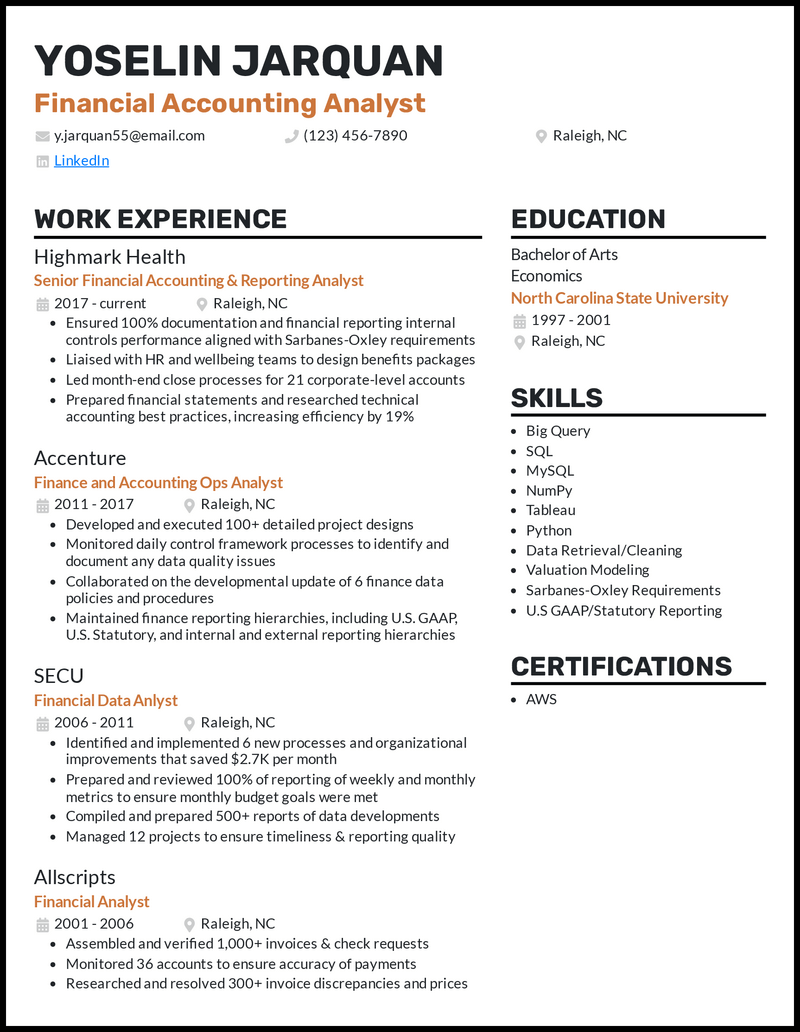

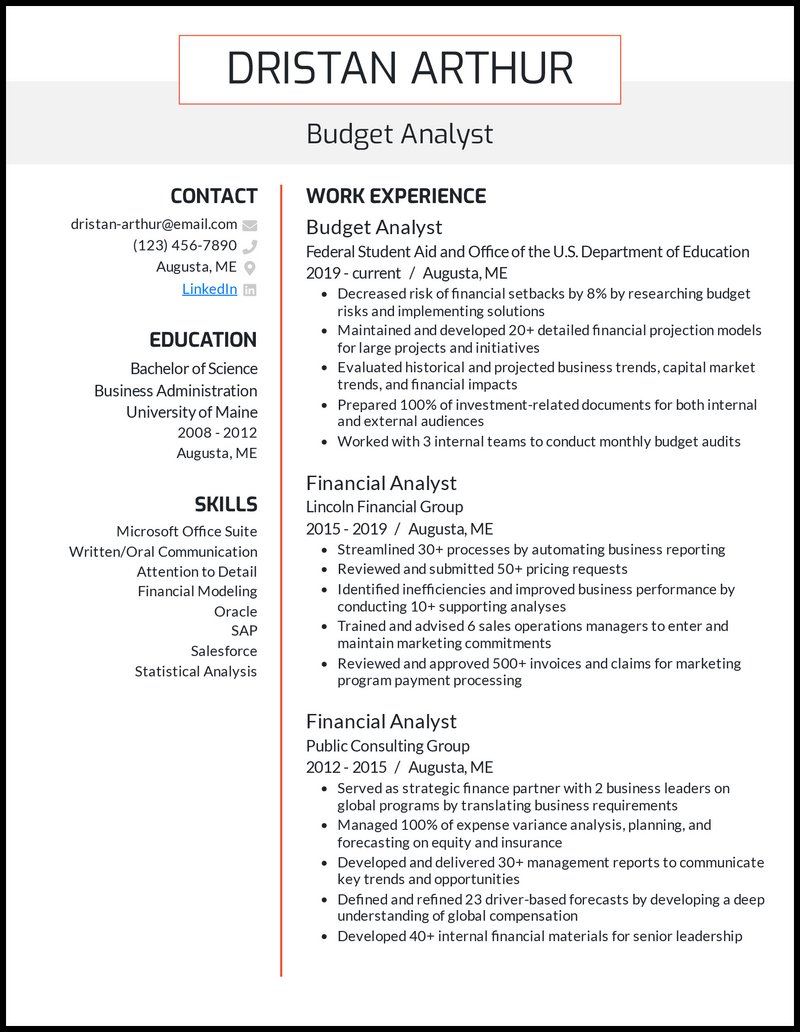

We’ve meticulously researched and analyzed countless financial analyst resume samples from all career stages in different industries, resulting in the creation of 17 resume samples to help you create a resume and land more interviews in 2025. Plus, our writing guide will give you plenty of resume tips so you hit the right note every time!

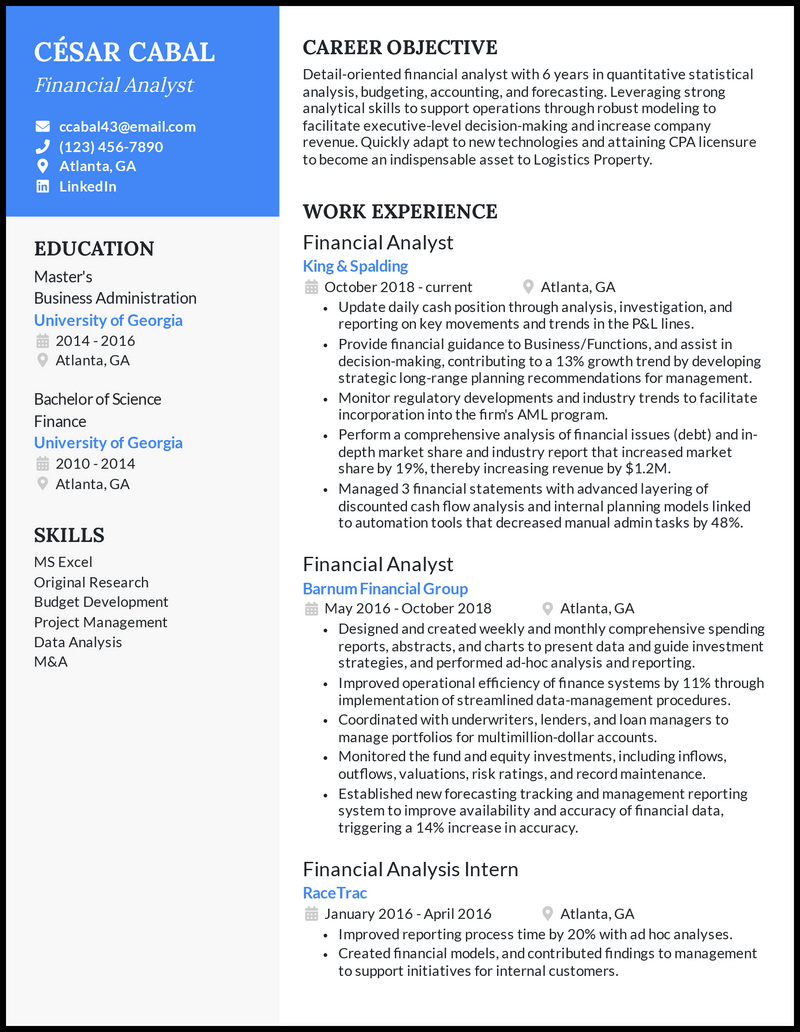

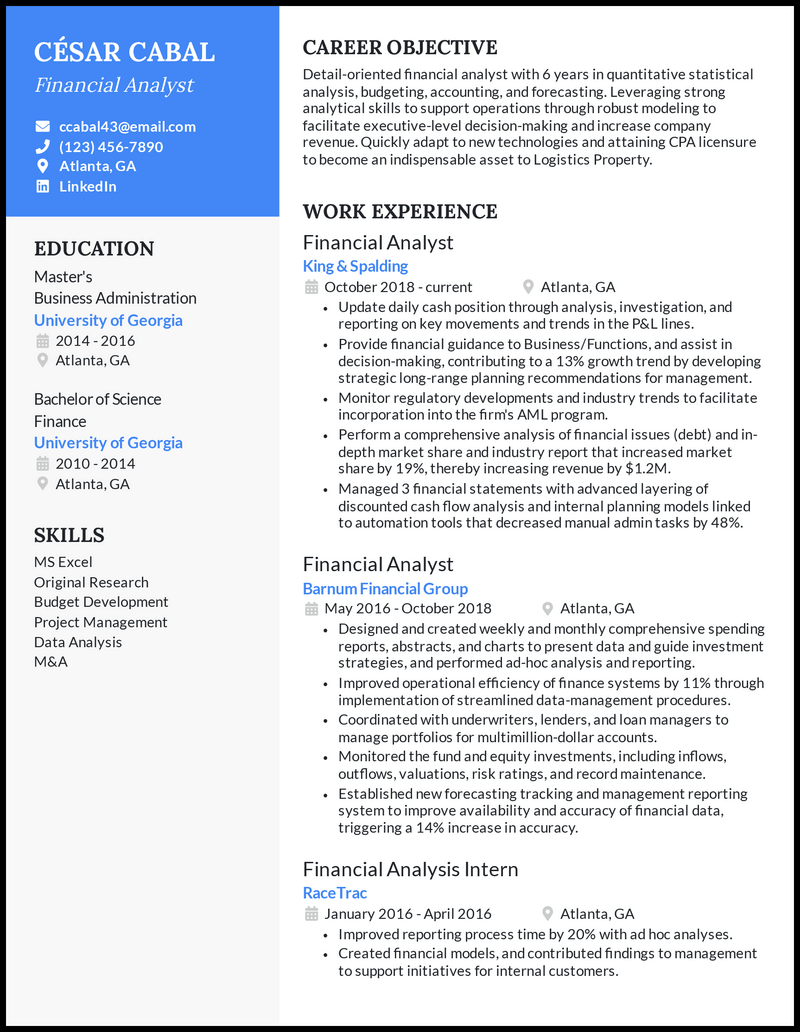

Why this resume works

As a financial analyst, you want to showcase your attention to detail. That means your resume needs to be finished and error-free.

Run your resume through a resume checker to ensure you include enough stats and don’t have grammar or punctuation errors, but don’t forget to check it yourself!

Your number one responsibility is turning data into actionable recommendations. It’s time to brag about “how” your role directly impacted the company and its clients, so be sure to add your statistics knowledge to your your financial analyst resume.

Don’t forget to include your projections and forecasts! Focus your financial analyst resume experience on how close your projections and forecasts were for the company and “how” those accurate projections and forecasts helped the business.

Click on a job title below to expand and see the resume details.

No results found

No results found

No results found

No results found

No results found

No results found

No results found

No results found

No results found

No results found

No results found

No results found

No results found

No results found

No results found

No results found

No results found

Writing Your Financial Analyst Resume

You might be tempted to think that the only thing that matters on your resume is the content, but proper resume formatting is almost as important. Even if you have decades of impressive financial analyst experience, it’ll be hard for a hiring manager to look past poor formatting. A well-formatted resume will be readable for ATS and logical for hiring managers who only have a few moments in their day to look at your resume.

Let’s review some of the most important aspects of resume formatting, including:

- Resume formatting choices

- How to include your contact information

- Outwit the ATS

Resume format choices

Each of the following formats performs a particular function, highlighting your work experience, skills, or both.

Three resume format favorites among successful job applicants in 2025.

- Reverse-chronological format: This format is exactly what you think: it orders your work experience starting from the most recent. This format will help hiring managers see your most relevant (and likely most impressive job title) first.

- Functional format: Unlike the reverse-chronological format, the functional formats place the most emphasis on skills. If you have employment gaps, you may want to consider this format, but be aware that hiring managers may be confused or wonder if you’re being forthcoming.

- Combination/hybrid format: This format weights work experience and skills equally by combining functional and reverse-chronological formats.

For financial analysts, we almost always recommend reverse-chronological formatting. Hiring managers love that it’s easy to read and skim, and you’ll love that it showcases your most senior position.

How to include your contact information

When a hiring manager wants to reach out for an interview, it’s important to make your name, phone number, and email easy for them to find. Ensure your contact information is highly visible by placing it at the very top of your financial analyst resume.

Use a large font for your name and a large (but slightly smaller) font for your job title. Both your name and your job title should be centered in the header.

If you want to try using color in your resume we suggest using the color as the backdrop for your contact information header. Professional colors for financial analysts include navy, amber, or dark green.

Below your header, you’ll need to include contact information, which should include:

- Phone number

- Your city and state (optional but recommended if it’s a local business)

- Professional links, such as LinkedIn (optional)

Like the example below, you can do a lot with your header to showcase your creativity while remaining professional.

Outwit the ATS

If you’re applying to an online job posting, the chances are high that the hiring manager is using applicant tracking system software (ATS) to pre-filter applicants.

The ATS works by picking up on words used throughout your resume and matching them to keywords selected by recruiters (usually keywords in the financial analyst job description). If you don’t have enough keyword matches, your resume may be thrown out before anyone can read it. That’s why your resume must be ATS-friendly.

Be careful to adhere to the following formatting guidelines:

- Margins: Use standard one inch margins, or at the very least half an inch, if needed to save space.

- Font type: Keep it basic by using Times New Roman, Arial, Cambria, or Garamond.

- Font sizes: The body of your resume should be a 12-14-point font, but you can make it slightly smaller (but only slightly) if needed. Your job title should be larger, around 20-point font, and your name should be about 24-point font.

- Header names: Use colors, bolding, or complementary fonts to help your subheaders stand out throughout your resume. Just make sure your font is readable.

- Skills: Customize your skills section for every job to which you apply. Carefully read the job descriptions to determine what keywords the recruiters will be scanning for while avoiding plagiarizing their job posting!

- Logical order: As we mentioned earlier, reverse-chronological order is the best for your financial analyst resume, and ATS operates under the assumption that your resume is formatted this way.

- Page count: Do everything you can (adjust font and margin, within reason) to fit the page perfectly. Your resume will look unprofessional and burdensome to read if it’s over a page. If your resume is a little short, recruiters will wonder if you’re inexperienced.

Formatting your resume isn’t easy at first, but once you’ve used an AI resume maker for the first time, all you need to do is minor tweaks for each job application.

Write your financial analyst resume

Writing your perfect financial analyst resume can be difficult especially with a job at stake. We know that writing an effective resume may feel overwhelming, but if you take it one section at a time, the process shouldn’t be too stressful.

Without further ado, let’s dig into the content of your financial analyst resume. Here’s what we’ll cover:

- Using a resume objective or summary statement

- Writing about your work history

- Key skills for financial analysts

- Education and optional sections

- Customizations

- Flawless editing

Understand the elusive objective/summary statement

Objectives and summaries are some of the most commonly misunderstood sections on a resume, but they can be useful. However, choosing between a resume objective or a resume summary is difficult because there are only a few circumstances in which you’ll use either one.

Both are highly job-specific, two to three-sentence paragraphs used near the top of your resume (often under your job title). An objective is for entry-level candidates or job seekers who have recently changed fields. An objective will tell hiring managers why you want the job.

On the other hand, a summary is for professionals with over 10 years of experience in a specific field. It highlights skills you’ve developed and biggest achievements.

Neither the objective nor the summary is a mandatory inclusion on your resume, but these statements can enhance your resume and boost your chances of getting hired. Let’s go over a few examples:

Example 1: Young professional seeking a job at your office to continue advancing my career in finance.

What could be improved: This is a poorly written resume objective. You should mention the specific job title you’re applying to, the company name, and one to three highly-specific skills you possess that will improve or contribute to the company’s operations.

Example 2: Working in finance with experience in organizing and communicating.

What could be improved: This summary is too bare-bones. It contains no meaningful information and just takes up space.

Example 3: Financial analyst with 7+ years of experience specializing in informative and persuasive professional presentations, seeking a role to utilize my depth of ROI and client relations skills as a team player at Spectrum.

What we like: This objective and the example below mention a specific job title, the company name, and the skills they bring to the table. It’s short and effective.

Example 4: Data-driven financial analyst with 23 years of business valuation and trend analysis under 3 major Fortune 500 corporations. With skills across many areas of data analysis and presentation, trend forecasting, and financial advisement, I provide a wealth of knowledge and business know-how to companies with which I’ve worked. I am eager for an opportunity to improve ROI in several key areas to optimize growth at BetterMent.

What we like: This summary (and the example below) are specific and contain information that makes this candidate an obvious choice. The applicant above also points directly to an area they know they can improve business operations. You want a hiring manager to read your summary and think, “we need this person.”

How to include your financial analyst work history

It should come as no surprise to you that the most important section of your financial analyst resume is your work history. It can be tempting to cram every job title you’ve held onto the page, but hiring managers prefer applicants who focus on the most relevant and recent work experience they’ve had. You can share information about older jobs and internships during your interview! You’ll want to include two to four job experiences.

Write descriptive bullet points

Your work experience should be broken down into bullet points, which make your resume look more organized and easier for hiring managers to read.

- Throughout your bullet points, you’ll want to avoid passive voice, which can make text boring to read and unengaging. Instead, use active voice, which exudes confidence and ownership of your work. Adding action words to start each bullet point, like “operated,” “spearheaded,” and “orchestrated,” will further engage readers and break up your text.

- You’ll also want to be careful to avoid personal pronouns, like “I” or “my.” Employers already know you’re writing about yourself, and personal pronouns sound unprofessional.

- You can choose to end all of your bullet points with or without periods. Consistency is key.

- Finally, you’ll want to consider verb tense. You can leave your current work experience in the present or past tense, but all of your former work experience must be in the past tense.

Here are a few examples of good bullet points that incorporate these tips:

- Oversaw the financial due diligence of a $52M acquisition, including organization and report analysis

- Developed an automated process using Excel for the internal team KPI reporting that increased accuracy by 17% and provided data 2 days faster to team leads

- Monitored 10+ regulatory developments and industry trends to incorporate into the firm’s AML program

These bullet points are perfect for a financial analyst resume. They’re written in active voice, using action verbs, avoiding personal pronouns; they’re all written in the past tense, with consistent punctuation.

Leverage numbers

Numbers demonstrate your value to the company, unlike words alone. We’ve interviewed countless hiring managers to ask them what they consider the most important element of a successful resume; almost unanimously, they’ve reported that metrics made applicants much more likely to get interviews. For the best results, aim to include quantifiable metrics on at least 50 percent of your bullet points.

Here are a few ways you might consider adding metrics about your past roles in financial analysis:

- Hard numbers: Discuss the details of your work. What percentage have you increased ROI? What percent have gross earnings increased for the company during your time of employment?

- Sales: Discuss the rate of potential clients converted from your presentations, the number of presentations you provided, and the success of your sales strategies.

- Reports: Have you successfully forecasted trends? Have your abstracts and internal presentations resulted in financial gain for the company?

- Collaboration: Financial analysts need to collaborate across departments frequently. Let employers know you collaborate well with others by detailing the number of people or departments with which you’ve worked.

If you’re having trouble visualizing how you’d use these questions to come up with numbers, don’t worry. Here are a few examples:

- Provided financial guidance to Business/Functions, contributing to a 19% growth trend by developing strategic long-range planning recommendations for management

- Collaborated with 10+ major clients with multi-million dollar accounts

- Created forecasting tracking and management reporting systems to improve the availability and accuracy of financial data, triggering a 13% increase in accuracy

- Evaluated regulatory developments and industry trends to facilitate incorporation into the firm’s AML program, reducing time to meet trend demands by 40%

Financial analyst skills to include in your resume

The skills section is an important place to demonstrate your value to potential employers, not to mention it’s one of the best places to include keywords for ATS. Unfortunately, many hopeful applicants don’t emphasize the right skills. The right skills for your financial analyst resume will depend on the specific job to which you’re applying.

Generally, we recommend including a mix of soft and hard skills, with the majority being hard skills because they’re easier to measure and more job-specific. Aim to include six to ten highly relevant skills on your resume.

Use the following financial analyst skills as examples to get you started:

- Financial Modeling

- Cash Flow Management

- Financial Reporting

- Quantitative Finance on Python

- Electronic Trading Systems Development

- Data Consolidation

- Predictive Analysis

Why are these resume skills appropriate? We’ve included a mix of hard and soft skills specific, measurable, and highly desired by most employers. When looking for your next financial analyst job, be sure to read the job description carefully. Often, you’ll be able to pick up on which skills are the most important to your hopeful employers.

But, a word of caution: avoid overselling your skills. If you don’t know how to do something or are inexperienced, leave it off your resume. Hiring managers want honesty above all.

Education + optional resume sections

ou probably already know that the financial analyst world can be a tough place in which to get your career started. Though there are no formal educational requirements, most employers will seek applicants with at least a bachelor’s degree in a relevant field.

Include the highest education level on your resume, but avoid including too much detail unless you’re a recent graduate with limited work experience. If you have minimal experience, you can utilize your education to demonstrate your working potential. Still, if you’re a more experienced applicant, you only need to provide your school name, graduation year, and degree.

There aren’t any formal requirements for certifications for financial analysts, but you should mention any specialized training you’ve received, such as a Financial Analyst Certification, Data Analysis Certification, or Certified Software Quality Analyst.

Finally, you may be wondering whether you should include any interests and hobbies to your resume. Generally, we don’t recommend including them, but there are a few instances where they’re appropriate additions to your resume:

- If you don’t have a great deal of work experience, it may be helpful to highlight some interesting hobbies or volunteer activities in which you’ve taken part. These can be great talking points during interviews if used appropriately!

- If you’re a recent graduate seeking your first finance job, you likely lack a lengthy work history to share on your resume. In this case, you can use interests and hobbies to convey to employers that you’re a hard worker and someone who thrives under pressure.

Tailor your financial analyst resume to the job ad

We’ve mentioned it a few times, but it’s important enough to reiterate. You need to tailor your financial analyst resume for every job to which you apply. Specifically, if used, your resume objective or summary statement needs to be customized with specific job titles and company names. Your skills section should be tailor-made to the job, too. You can do this by referencing skills mentioned in the job description (without ever copying anything from the job posting verbatim). Finally, your bullet points should be tailored to fit the specific needs of each company.

Don’t submit a sloppy financial analyst resume

We know it’s difficult to take a step back after you’ve finished working on your financial analyst resume. However, we strongly recommend that financial analysts, and all job seekers, take a step back. Put your resume away for a day or two, and then look it over again for typos. Have friends or family proofread it, and take advantage of a free AI resume review.

One step closer to your next job

Congratulations! The first step to writing your professional financial analyst resume is research. If your resume is complete, you can upload it to see what AI-powered tips our resume checker has for you before making a cover letter.

If you haven’t started yet, or if you want to start your resume from scratch, use our resume builder. Both our resume checker and builder will analyze your resume and provide specific tips on how you can make improvements.