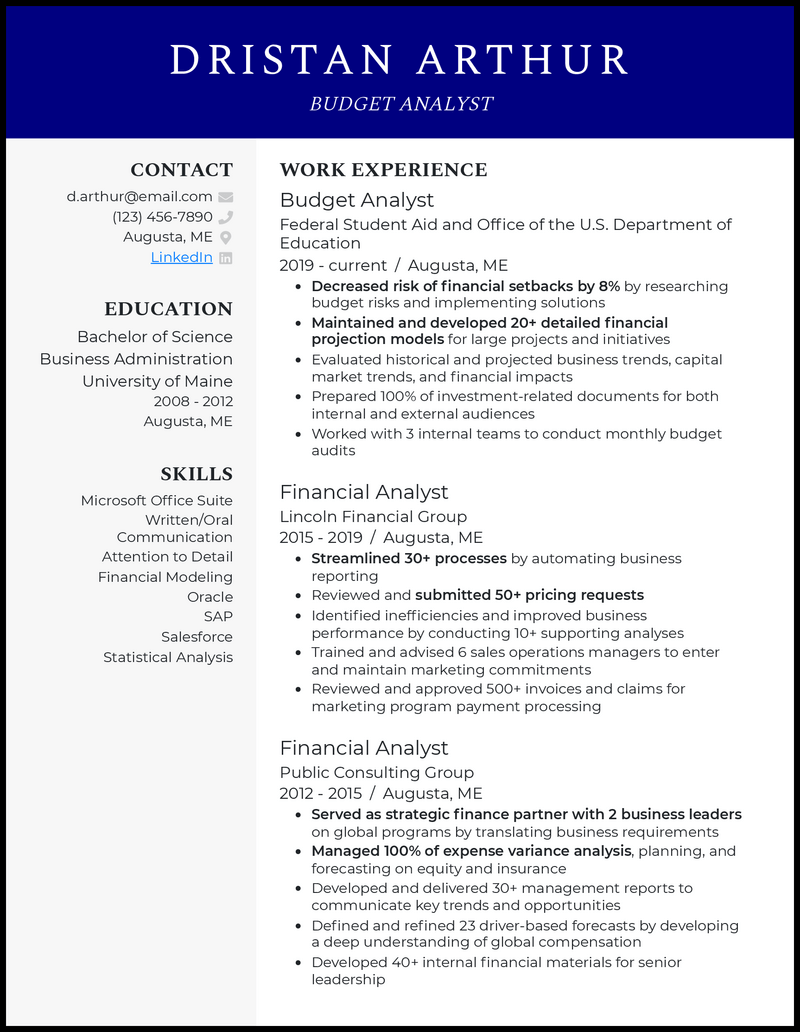

You focus on the day-to-day financial operations of a business, using insights from financial planning and data analysts to guide your hand as you develop organizational budgets, assess funding requests and concerns, and process vendor payments. You might also provide financial guidance for company projects or programs.

But you might still need some advice for a resume! How do you clarify your niche within a company’s financial ecosystem? How do you maximize your credibility?

Don’t worry! We’ve got three budget analyst resume samples that have helped others like you, alongside some time-tested advice to get you started! And for the perfect job application, try our free cover letter builder.

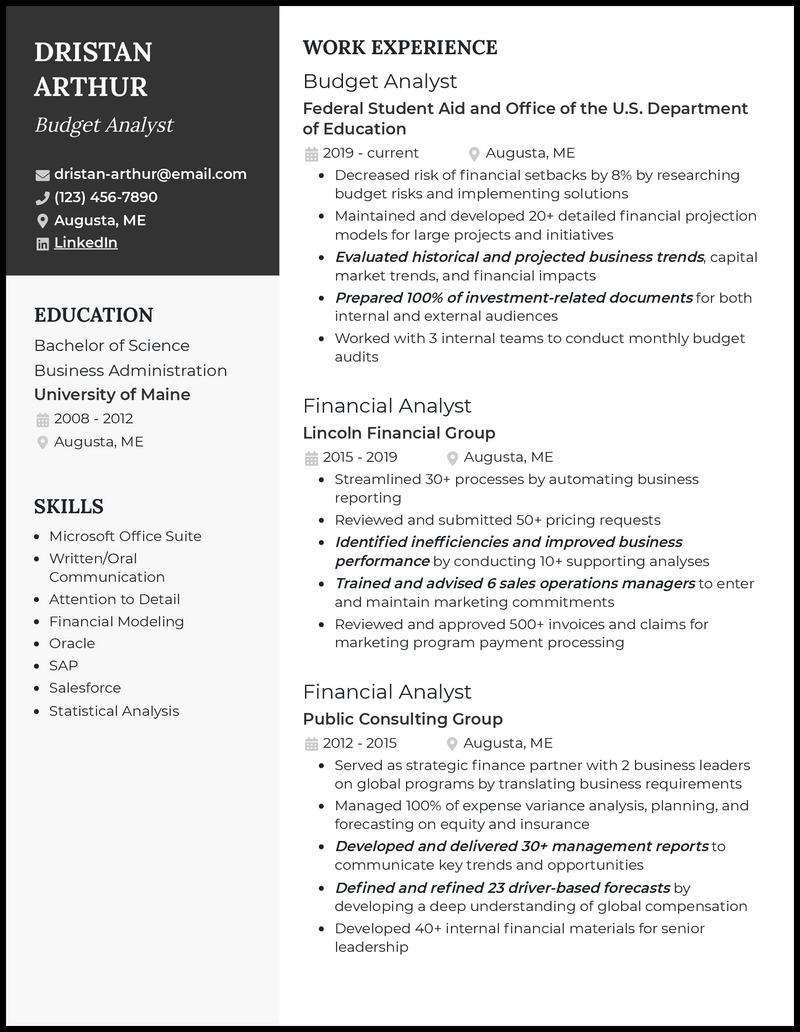

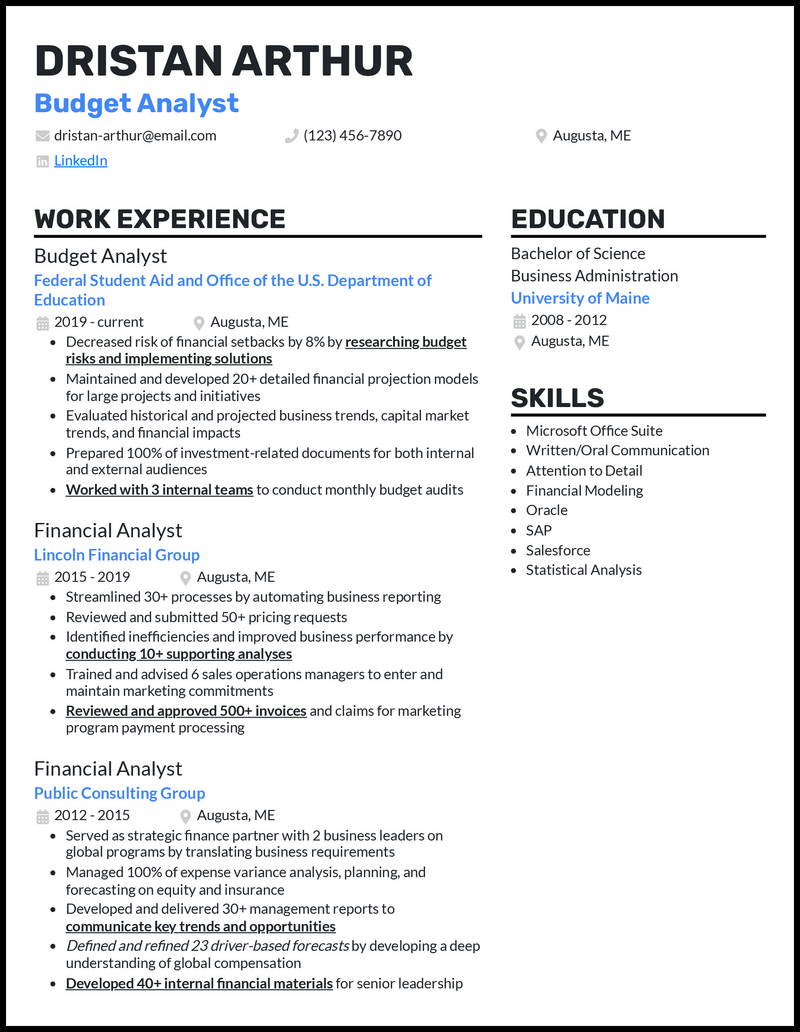

What Matters Most: Your Skills & Job Experience

Your resume skills show recruiters exactly how well-versed you are in your job role—now’s your chance to boast your statistical analysis skills! And don’t forget to touch upon your ability to bridge the gap between data and people with a blend of hard and soft skills.

No matter what types of abilities you’re listing, be technical about how they relate to budget analysis. Avoid anything vague like “presentations” or “communication” since these don’t clarify what makes you a great budget analyst.

Be highly specific about your skills and choose crystal-clear examples of what you can do, like financial modeling. Reference programs like Salesforce by name.

9 top budget analyst skills

- SAP

- MS PowerPoint

- MS Excel

- Oracle

- Financial Modeling

- Statistical Analysis

- ROI Analysis

- Data Entry

- Data Reporting

Sample budget analyst work experience bullet points

While your analysis and software skills are certainly impressive, recruiters want to see what you’ve done with them! How did you leverage your data analysis skills to improve budget efficiency?

Make sure your experiences are highly relevant to your field and show a clear, positive impact. Share how you’ve made improvements to program budgets and successfully projected business trends to boost profits.

Always make sure you measure that impact with numbers, too! Quantifiable data is a huge factor in your credibility: Provide metrics like profit increase and risk decrease percentages and dollar savings.

Take a look at these samples:

- Managed 97% of variance analysis, planning, and forecasting on equity and insurance to reduce company expenditures by 24%

- Prepared investment-related documents for both internal and external audiences, boosting program planning efficiency by 11%

- Decreased risks of financial setbacks by 8% by researching budget risks and implementing solutions

- Reviewed and submitted 54+ pricing requests, using MS Excel to reduce error rates by 14%

Top 5 Tips for Your Budget Analyst Resume

- Show your versatility

- You need broad market and trend knowledge to pull off your job with finesse! Demonstrate that you can adapt to changing financial climates and various departments’ needs by citing a diverse set of relevant experience points.

- Demonstrate depth of knowledge

- When you describe your accomplishments, mention trade-specific details like “sales operations management” and “strategic financial partnerships” whenever applicable to show familiarity with the finer details of your job role.

- Leverage your background

- Use context to spruce up your professional experience points. Giving a few words of backstory can make your accomplishments really pop: “forecasting on equity and insurance” is much stronger than “forecasting!”

- Keep your layout clean

- Don’t bring in weak points to try and fill up your resume template, and don’t go overboard with unusual colors or fonts, either. Your budget analyst resume should be as clean and readable as your data reports and transaction logs!

- Use a cover letter

- This is your golden opportunity to expand on your qualifications by listing any points that could not fit well on your resume. If you have a more complex story about how you used financial modeling and trend prediction to save your company from an expensive curveball, you’ll have more room to talk about it when you create a cover letter.

Definitely! Include the degrees you’ve earned if they’re relevant to your field—think economics, business administration, or accounting. If you have education beyond a bachelor’s degree, list your education in reverse-chronological order.

The best resumes stay at one page to show how concisely you can wrap up critical data. Recruiters probably won’t read your second page—and why pass up an opportunity to demonstrate your efficiency and clarity as a budget analyst?

Reference more complex accomplishments and increasing success metrics as you move toward the present in your reverse-chronological resume. Evolve from smaller expense planning projects to cross-departmental recommendations and advanced projection models.