Accounts Receivable

Best for professionals eager to make a mark

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

As an accounts receivable specialist, you play a crucial role in managing a company’s finances. Your expertise lies in handling invoices, tracking payments, and ensuring timely collections.

You excel in analyzing financial data, identifying discrepancies, and resolving payment issues. Building a resume that showcases this efficiency isn’t easy, but we’re here to guide you through it.

Just as you’re the master of the financial domain, we know all about resume writing. With our accounts receivable resume examples and handy resume tips, you’ll have companies lining up to interview you!

Why this resume works

- Recruiters will be more interested in your accounting skills and how you used them to achieve goals, streamline workflows, and most importantly, drive up profits.

- Apart from the relevant skills, include measurable accomplishments such as reducing probabilities of bad debts, minimizing costs, and maximizing profit margins to make your accounts receivable resume stand taller than your competition.

Why this resume works

- Lowering reconciliation discrepancies, identifying customer payment behavior, and streamlining invoice processes are just some of the many impacts your account receivable manager resume should include.

- Don’t use generic points with zero metrics. For each bullet point you create, refer to and add the amount of money or time it saved for a previous company. You can take inspiration from Charlotte and see how they make mention of “reducing transaction costs by 9,673” via cost-benefit analysis.

Why this resume works

- As a supervisor, you need to display your expertise and grasp over handling various accounts. A good way of doing so is by adding a bachelor’s degree in finance and accounting.

- Such courses usually expose various forms of accounts to students and prepare them to deal with them in real life. You can also back such qualifications in your account receivable supervisor resume with in-demand skills like Stripe to show your versatility.

Why this resume works

- You don’t walk into the finance field as the top dog on day one. Working your way up the ranks takes more than crunching numbers 24/7.

- Outline your career growth and how you’ve transitioned from being an account receivable specialist to a senior manager. Also, don’t skimp on numbers and add impactful gems like “lowered Days Sales Outstanding (DSO) by 7%” throughout your senior accounts receivable resume.

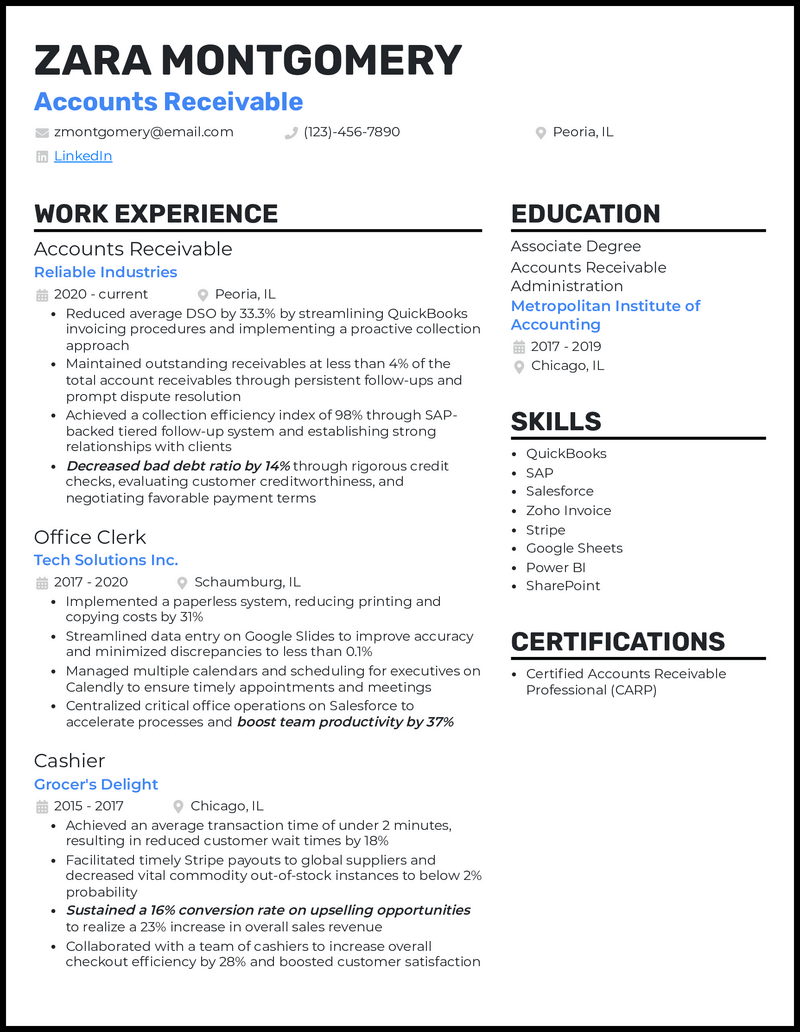

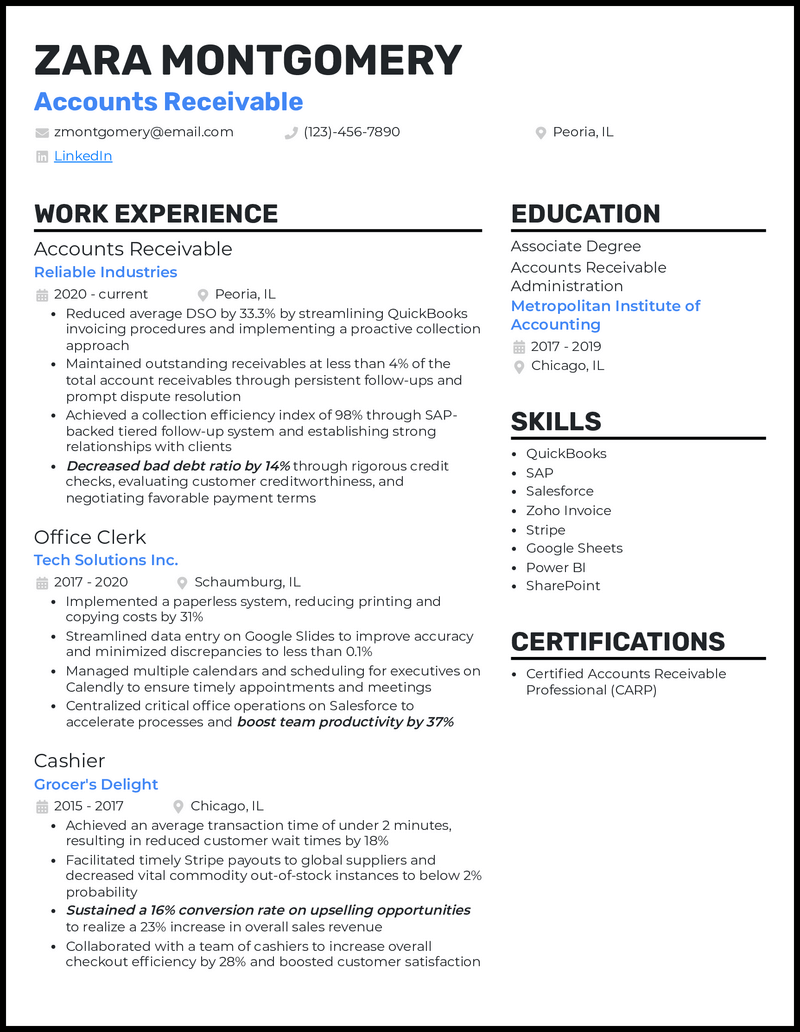

Why this resume works

- If there’s one thing no employer can’t overlook, it’s the importance of credible certificates, especially in the field of finance. Have something like a Certified Accounts Receivable Professional (CARP) certificate under your sleeve? Unleash it!

- Such achievements show employers your dedication to accounting even if you’re fresh out of college. With the right certs in your entry level accounts receivable resume, you’re not an average financial Joe—you’re the financial ace companies can’t afford to lose out on.

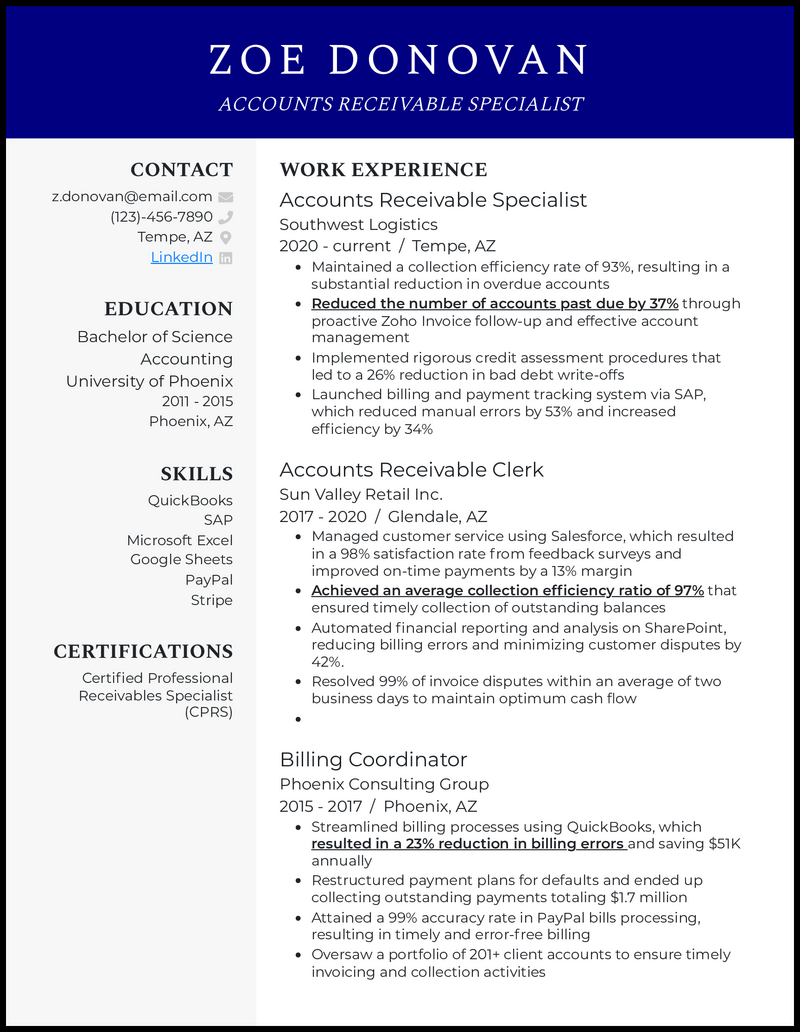

Why this resume works

- Accounting jobs are highly demanding, and recruiters want to ensure they hire the best person for the role. You must prove your deep understanding of accounting principles and how to use them to streamline cash flow, manage billing, and ensure uninterrupted business operations.

- Consequently, your accounts receivable specialist resume must show strong competencies in bookkeeping, account reconciliation, auditing, and the ability to leverage technology to manage core business functions.

Why this resume works

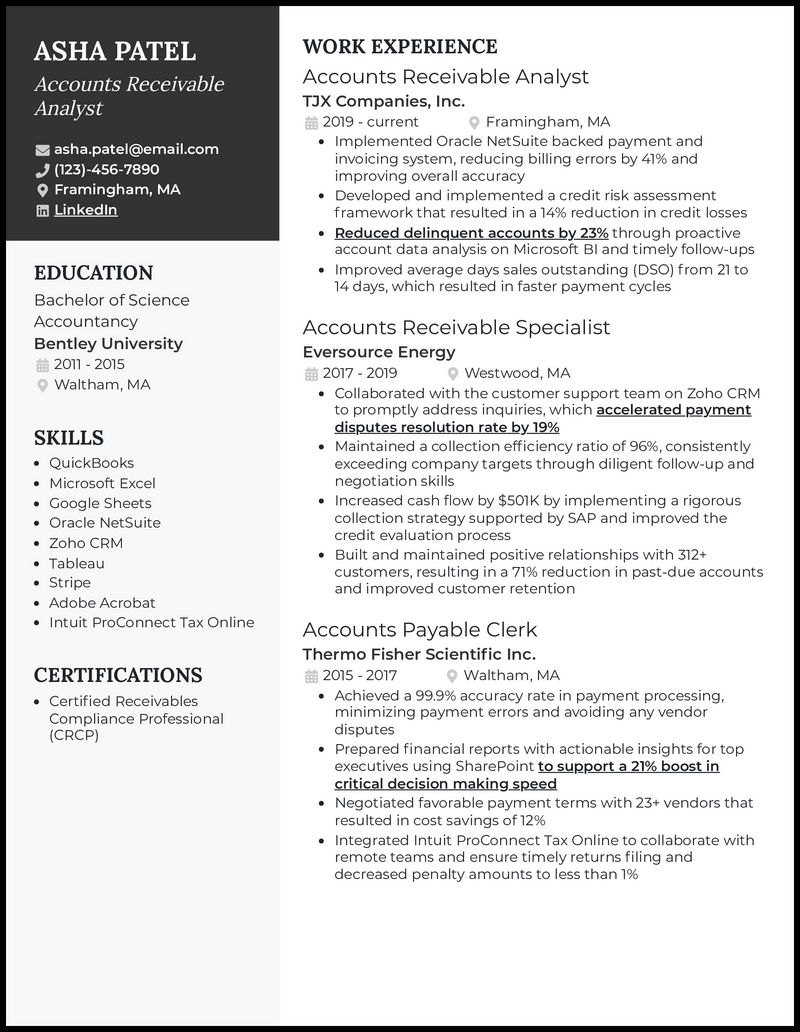

- Analyzing numbers, drawing insights, and making decisions are part and parcel of your accounting job. Therefore, your application of skills learned through experience to maintain healthy financial records will be something that would impress potential employers.

- To add icing to your accounts receivable analyst resume, highlight quantifiable metrics in cutting costs, automating processes, reducing bad debts, and using tech solutions to support core business operations.

Why this resume works

- Got important work experience metrics, but not enough to fill the entire page? Be smart with what template you choose. Avoid using designs that make your points look like tiny footnotes.

- Take inspiration from the accounts receivable collections resume above and try using the Professional template. It’s got just the right amount of space to ensure even shorter points shine, keeping your resume crisp and dapper.

Why this resume works

- Now, just because coordinator sounds fancy, it doesn’t mean you can skip the basics and only mention past experience. Don’t forget to include your education qualification and show employers that you’re prepared to monitor real-world accounts.

- Adding a bachelor’s in accounting in your accounts receivable coordinator resume is going to be the best option here. Got relevant courses like Managerial Accounting or Auditing? Mention them to add a little extra credit to your name.

Why this resume works

- Now, you can’t really mess this one up because the job title shows what you need—a bunch of SAP modules in your back pocket.

- Include all SAP modules in your SAP accounts receivable resume (like FICO and Ariba) and show them in action. For example, try, “Used the SAP FICO module, increasing the accuracy of financial reporting by 17%” to prove that you’re not just proficient in using SAP, but making marginal impacts with it, too.

Why this resume works

- Managing medical accounts requires you to be active for various tasks every day. From typical billing to insurance claims, there’s going to be a lot on your plate.

- Here’s when action words are going to help you out. Before writing bullet points for your medical accounts receivable resume, ensure that each sentence starts with a strong verb such as Resolved, Processed, Audited, and Oversaw which highlights your ability to juggle everything that comes your way.

Why this resume works

- Being a whiz with numbers doesn’t mean you can’t be good at design. The last thing you want to risk is creating an accounts receivable administrator resume that employers can’t stand looking at.

- So instead of clustering everything into a tiny space, try using well-spaced fonts that don’t look unprofessional. Also, if you’re using a resume builder, play around with spacing to avoid that awkward chunk of blank space at the bottom.

Related resume examples

Adapt Your Accounts Receivable Resume to Match the Job Description

One golden rule of resume writing is to include as many relevant skills as you can, which means the ones in the job listing. For accounts receivable analysts, this means highlighting technical expertise relevant to the position, including proficiency in financial software, accounting tools, and data analysis.

Mention your in-depth knowledge of financial regulations, invoicing processes, and payment tracking systems. If the job description asks for specific software like QuickBooks, make sure you put it right near the top of your list.

Though the job likely also calls for soft skills like communication, negotiation, and problem-solving, it’s better to demonstrate those in the work experience section than list them here—they’ll hold more meaning when backed up with examples.

Need some inspiration?

15 popular accounts receivable skills

- QuickBooks Online

- SAP

- Data Analysis

- Power BI

- Microsoft Excel

- Sage Intacct

- Debt Reconciliation

- Credit Analysis

- Netsuite ERP

- Financial Reporting

- Stripe

- SharePoint

- Adobe Acrobat

- Coupa Invoice

- Tableau

Your accounts receivable work experience bullet points

The best work experience sections go beyond naming routine tasks, so focus on showcasing significant achievements that have made a tangible impact on financial operations. The accomplishments you choose to highlight should be striking and impressive, covering both areas the job listing mentions and those you’re personally proud of.

For instance, you could talk about your effective streamlining of invoicing processes, reduction of outstanding receivables, or implementation of efficient collection strategies that enhanced cash flow.

Quantifying your achievements with specific metrics is the icing on the cake. What you can do is, as an example, include the percentage when you mention an increase in efficiency, and throw in the amount of money you process each week.

- Show off your talent for efficiency by mentioning how you reduced DSO averages.

- Highlight the effectiveness of your collections process by showing improved CEI and increased optimization.

- Mention the percentage of overdue receivables you’ve successfully brought back to current status, showing your ability to follow up with clients and resolve payment issues.

- Showcase the percentage of uncollectible debts against total outstanding receivables, demonstrating your success in minimizing bad debt through strong credit risk assessment and debt management skills.

See what we mean?

- Implemented Oracle NetSuite backed payment and invoicing system, reducing billing errors by 41% and improving overall accuracy

- Maintained a collection efficiency rate of 93%, resulting in a substantial reduction in overdue accounts

- Reduced average DSO by 33.3% by streamlining QuickBooks invoicing procedures and implementing a proactive collection approach

- Decreased bad debt ratio by 14% through rigorous credit checks, evaluating customer creditworthiness, and negotiating favorable payment terms

9 active verbs to start your accounts receivable work experience bullet points

- Streamlined

- Spearheaded

- Led

- Optimized

- Implemented

- Revamped

- Negotiated

- Collaborated

- Achieved

3 Tips for Writing an Outstanding Entry-Level Accounts Receivable Resume

- Showcase transferable skills

- Even if your previous roles were not directly in the finance or accounting field, highlight transferable skills that are relevant to accounts receivable. Skills such as attention to detail, data analysis, customer service, and communication are valuable in this role, and you might have picked them up in other roles, too.

- All experience matters

- You can learn, practice, and use financial knowledge anywhere, so don’t be afraid to mention experiences that aren’t strictly work-related. Maybe you’ve engaged in volunteer work like helping your aunt sort out her finances, or you assisted with bookkeeping tasks for a campus organization. Use that background to your advantage in your resume.

- Demonstrate your willingness to learn

- Emphasize your eagerness to learn and grow within the accounts receivable field. Mention any ongoing education, courses, or workshops you’re attending to enhance your financial knowledge to showcase your enthusiasm and proactive attitude.

3 Tips for Writing an Accounts Receivable Resume as a Seasoned Pro

- Highlight your expertise

- If you have some experience as an accounts receivable specialist, showcase your specific areas of expertise, such as credit analysis, collections management, or dispute resolution. Make sure to cover any areas the job post mentions explicitly.

- Provide customer-centric examples

- Account receivable specialists interact with clients a lot, so it’s important to include instances where you’ve provided excellent customer service. This could include resolving billing inquiries promptly or establishing positive relationships.

- Emphasize problem-solving abilities

- Accounts receivable specialists often encounter complex payment issues and disputes, so problem-solving skills are essential to note in your resume. Also, when writing an effective cover letter, describe how you resolved challenging situations, negotiated payment arrangements, or implemented process improvements to prevent recurring payment delays.

Any certifications relevant to finance and accounting can help you elevate your resume. This includes certs like the CARS, CCCP, or NACM, as well as credentials related to financial analysis, such as the CFA.

To satisfy ATS, include plenty of relevant keywords from the job description in your resume, particularly skills pertinent to accounting and accounts receivable. Use standard fonts and formats to ensure ATS compatibility and avoid using images or graphics that might not be recognized by the system, and you’re good to go!

Focus on transferable skills that are relevant to both careers and emphasize your past and ongoing education. For instance, if you’re transitioning from sales to accounts receivable, you could highlight your strong communication and negotiation skills, as those can really come in handy in your new job!